"We expect a somewhat messy quarter due to accelerated phase-out of the Li ONE materially hurting margins," Deutsche Bank analyst Edison Yu's team said.

"We expect a somewhat messy quarter due to accelerated phase-out of the Li ONE materially hurting margins," Deutsche Bank analyst Edison Yu's team said.

The post Li Auto to report Q3 earnings on Dec 9, what to watch? appeared first on CnEVPost.

For more articles, please visit CnEVPost.

There are no major concerns about XPeng regarding liquidity in the near term and there is still time to win back market share, according to Edison Yu's team.

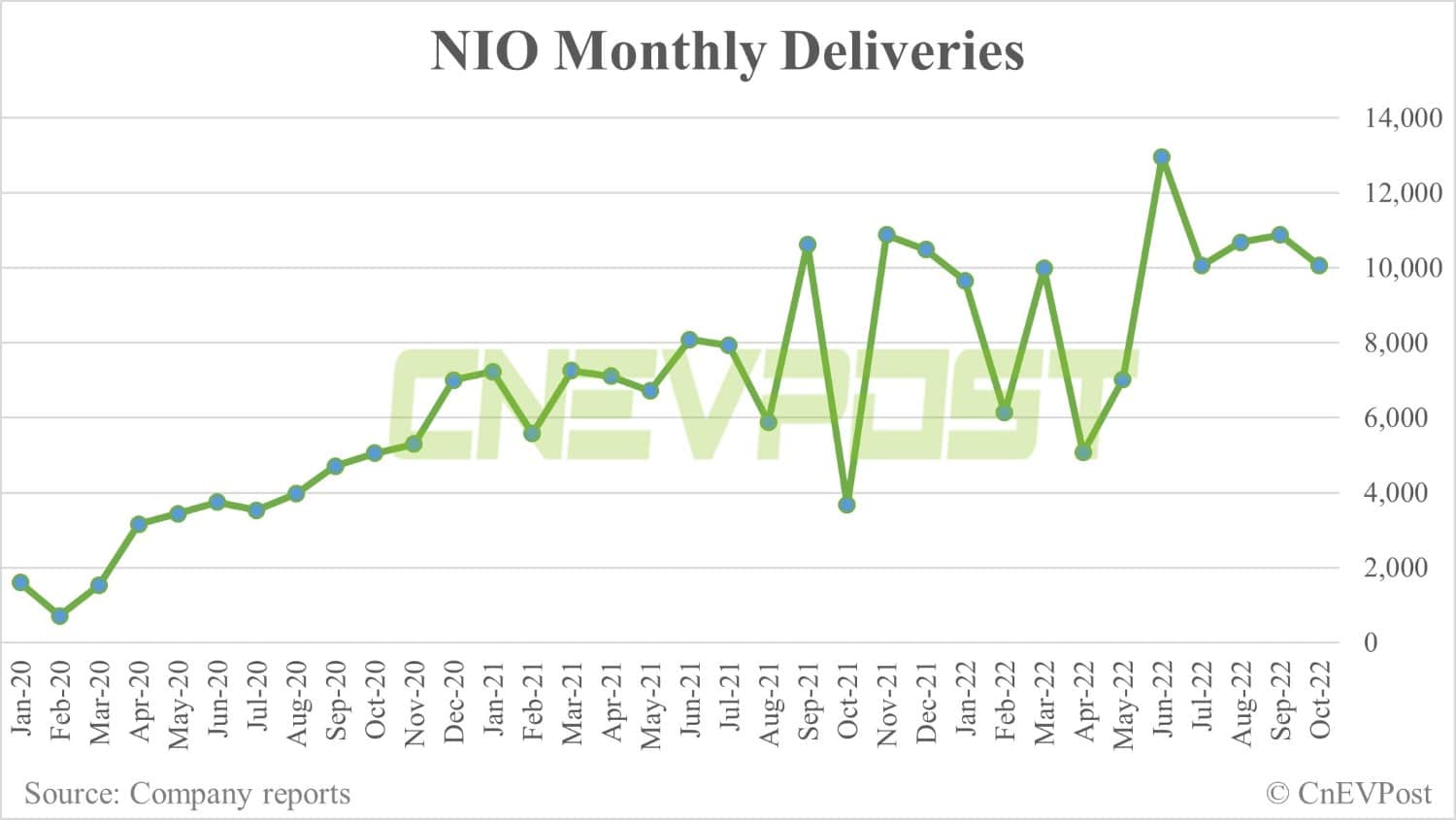

There are no major concerns about XPeng regarding liquidity in the near term and there is still time to win back market share, according to Edison Yu's team. Fab 5 China EV sales came in stronger than expected as new product cycles at Li Auto and NIO really start to kick in, leading to record monthly volumes despite a weak macro backdrop, said Edison Yu's team.

Fab 5 China EV sales came in stronger than expected as new product cycles at Li Auto and NIO really start to kick in, leading to record monthly volumes despite a weak macro backdrop, said Edison Yu's team. "We think a large part of the rally was caused by a short squeeze as investors were caught being too negative on the group given Covid and competition concerns," said Deutsche Bank analyst Edison Yu's team.

"We think a large part of the rally was caused by a short squeeze as investors were caught being too negative on the group given Covid and competition concerns," said Deutsche Bank analyst Edison Yu's team. XPeng delivered better-than-expected third-quarter operating results, accompanied by a slightly better-than-feared outlook.

XPeng delivered better-than-expected third-quarter operating results, accompanied by a slightly better-than-feared outlook. Morgan Stanley sees the price of lithium carbonate in China falling to $47,500 per ton in the second half of 2023, implying a 35 percent drop from the current spot.

Morgan Stanley sees the price of lithium carbonate in China falling to $47,500 per ton in the second half of 2023, implying a 35 percent drop from the current spot. The key to XPeng regaining relevance is winning back demand, and that could take several quarters, creating significant uncertainty heading into 2023.

The key to XPeng regaining relevance is winning back demand, and that could take several quarters, creating significant uncertainty heading into 2023. Edison Yu's team predicts NIO will deliver 13,500 units in November and 19,500 units in December.

Edison Yu's team predicts NIO will deliver 13,500 units in November and 19,500 units in December.