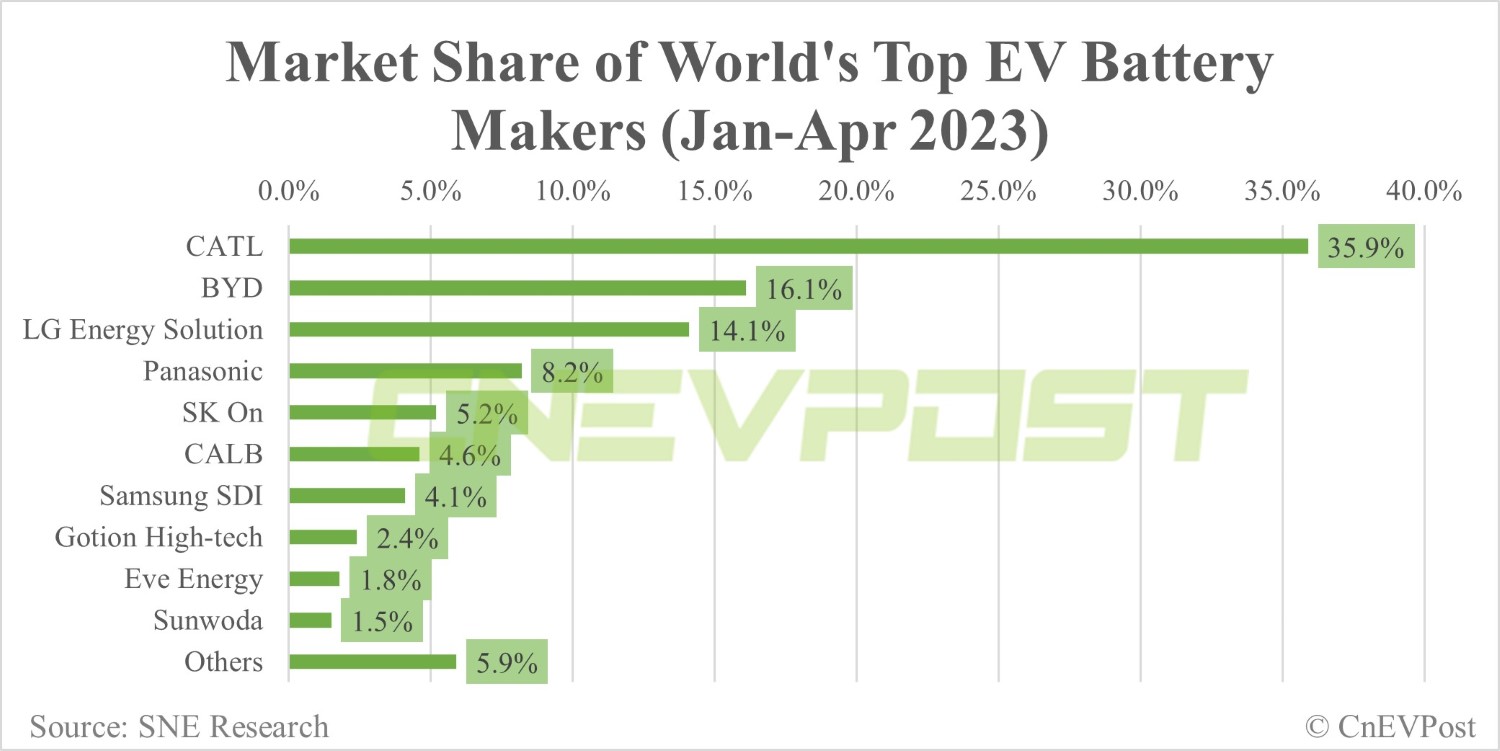

In January-April, CALB's power battery installations of 8.4 GWh surpassed Samsung SDI's 7.5 GWh, according to SNE Research.

China's CATL and BYD (OTCMKTS: BYDDY) continued to be the world's two largest power battery manufacturers in January-April, the latest data show.

In January-April, global battery consumption for electric vehicles (EVs) totaled 182.5 GWh, up 49 percent from 122.5 GWh in the same period last year, according to data released today by South Korean market research firm SNE Research.

Among them, CATL installed 65.6 GWh of batteries from January to April, up 55.6 percent from 42.1 GWh in the same period last year.

The Chinese power battery giant continues to rank No. 1 in the world with a 35.9 percent share and remains the only one in the world with a market share of more than 30.0 percent.

This was higher than its 34.4 percent share in the same period last year and up from its 35.0 percent share in the January-March period.

CATL's batteries are installed in many major passenger EV models in China's domestic market, such as the Tesla Model 3, Model Y, SAIC Mulan, GAC Aion Y and NIO ET5, as well as Chinese commercial vehicle models, and continue to grow steadily, SNE Research said.

BYD installed 29.4 GWh of power batteries from January to April, up 108.3 percent from 14.1 GWh in the same period last year.

The company ranked second with a 16.1 percent share from January to April, up from 11.5 percent in the same period last year but down from 16.2 percent in January-March.

BYD has gained popularity in China's domestic market with its competitive pricing by establishing a vertically integrated supply chain management, including battery self-sufficiency and vehicle manufacturing, SNE Research said.

With the launch of the Atto3 model, BYD showed explosive growth by expanding its market share outside of China in Asia and Europe, SNE Research said.

LG Energy Solution installed 25.7 GWh of power batteries from January to April, up 49.3 percent year-on-year.

The South Korean company ranked third in the world with a 14.1 percent share, unchanged from a year ago.

Japan's Panasonic was fourth with 8.2 percent share, South Korea's SK On was fifth with 5.2 percent share and China's CALB was sixth with 4.6 percent share.

South Korea's Samsung SDI of, China's Gotion High-tech of China, Eve Energy and Sunwoda ranked seventh, eighth, ninth and tenth respectively, with shares of 4.1 percent, 2.4 percent, 1.8 percent and 1.5 percent from January to April, respectively.

It is worth noting that CALB's power battery installed base of 8.4 GWh exceeded Samsung SDI's 7.5 GWh in the January to April period.

In January-March, CALB was 5.7 GWh, lower than Samsung SDI's 6.5 GWh.

In 2023, Chinese companies are expected to enter overseas markets such as the US and Europe in preparation for a gradual decline in growth rates in China's domestic market, the largest EV market, according to SNE Research.

The European EV market, which has relatively fewer political issues than the US, is attracting attention as a strategic point for seeking to diversify the battery supply chain, the report noted.

Going forward, the share of LFP batteries in Europe is expected to increase as Chinese companies enter the European market in earnest, the report said.

CATL unveils Condensed Battery for electric aircrafts and EVs

The post Global EV battery market share in Jan-April: CATL 35.9%, BYD 16.1% appeared first on CnEVPost.

For more articles, please visit CnEVPost.