After the price cut and a series of new models, Nio sales could reach 20,000 units per month in the third quarter, according to Edison Yu's team.

China's major electric vehicle (EV) makers recently announced their June deliveries, and Deutsche Bank analyst Edison Yu's team provided their take, as usual.

"June EV sales surprised to the upside as demand picked up, likely signaling some normalization in consumer behavior and release of pent-up demand from buyers taking advantage of low prices," the team said in a research note sent to investors today.

Li Auto (NASDAQ: LI) again led the way among the upstarts, setting a new monthly record, while Nio (NYSE: NIO) saw a large improvement in monthly sales, driven by the speedy ramp-up of the ES6, the team noted.

Looking ahead, pressure will be on Nio and Xpeng (NYSE: XPEV) to deliver big growth in the second half with new vehicle launches, while Li Auto works to increase its already strong order book, Yu's team said.

As a backdrop, Nio delivered 10,707 vehicles in June, up 73.96 percent from 6,155 in May, though down 17.39 percent from 12,961 a year earlier.

Xpeng delivered 8,620 vehicles in June, up 14.84 percent from May and the fifth sequential growth, despite a 43.64 percent decline from the same month last year.

Li Auto delivered a record 32,575 vehicles in June, surpassing the 30,000 mark for the first time.

Zeekr delivered 10,620 vehicles in June, up 146.86 percent year-on-year and up 22.38 percent from May.

Yu's team said Nio deliveries were slightly below their forecast, though the new ES6 appears to be ramping up smoothly and should be a bigger contributor in July along with the full month of production of the ET5 Touring.

After the price cut and a slew of new models, Nio could reach 20,000 units per month in the third quarter, the team said.

The team said Xpeng deliveries exceeded their expectations and, most importantly, the initial reception to the new G6 looks increasingly positive.

Looking ahead, Xpeng is on track to hit at least 10,000 deliveries in July and 15,000 in September is doable, the team said.

Here is the full text of the team's research note.

June gathering momentum

June EV sales surprised to the upside as demand picked up, likely signaling some normalization in consumer behavior and release of pent-up demand from buyers taking advantage of low prices.

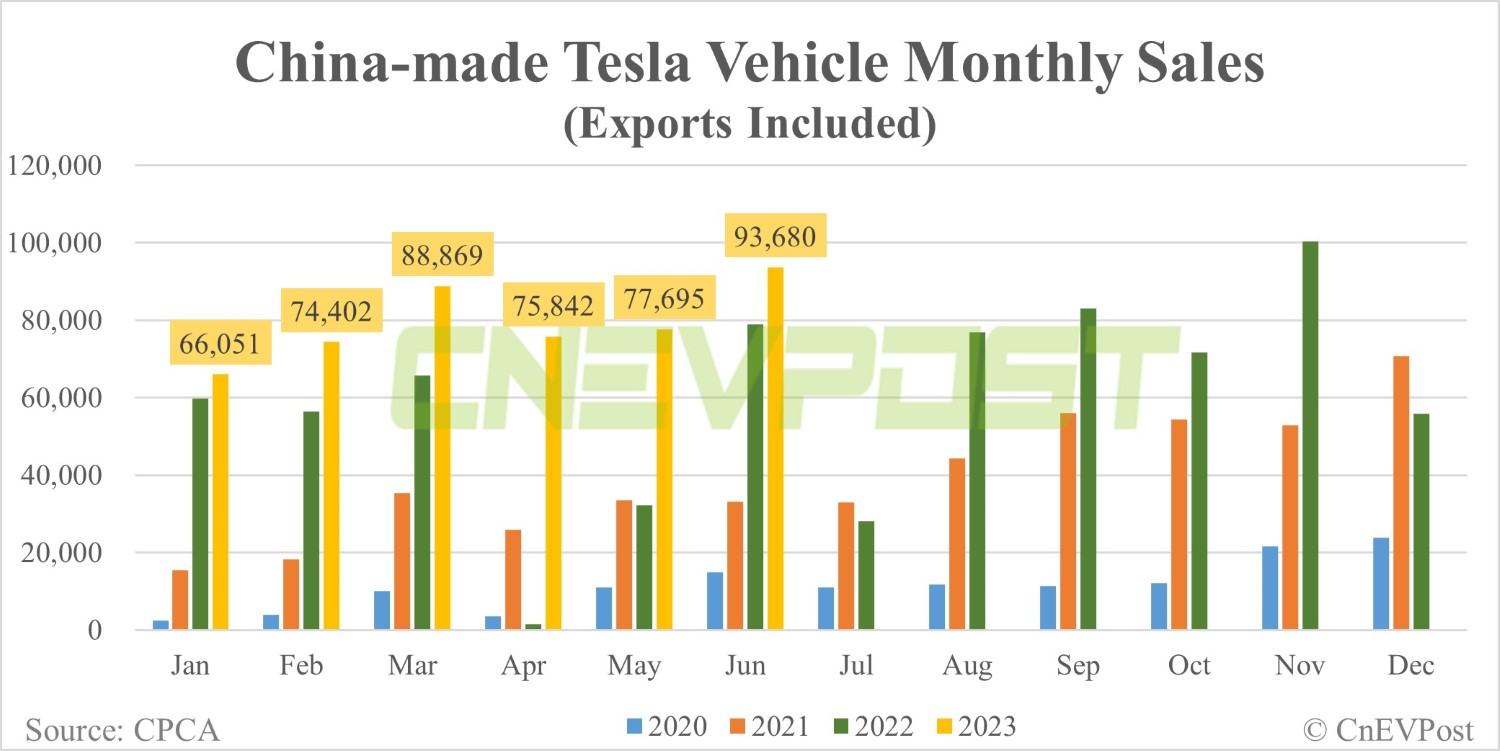

Total NEV retail sales appear to be tracking around 670k according to preliminary CPCA forecasts or +16 percent MoM (+26 percent YoY).

Li Auto once again led the way among the upstarts setting a new monthly record while Nio saw a large improvement MoM driven by speedy ramp up of ES6.

Looking ahead, the pressure will be on Nio and XPEV to deliver big growth in 2H from new launches while Li Auto strives to increase its already robust order book.

June OEM recap

Li Auto delivered 32,575 vehicles (+15 percent MoM; +150 percent YoY), easily beating our forecast. Looking ahead, management is targeting L8 and L9 to be +10,000 each and L7 at 15,000 in monthly sales for 3Q and then 40,000 total in 4Q.

To support this, we are expecting a cheaper variant of the L9 to be available later in the year.

Separately, the first BEV (Li MEGA) is set to be unveiled in 4Q, catering to the >500k RMB segment.

The company exited the month with 331 retail stores and 323 servicing centers.

Nio delivered 10,707 units (+74 percent MoM; -17 percent YoY), slightly below our forecast.

The new ES6 appears to be ramping up smoothly and should be an even bigger contributor in July along with a full month of ET5 Touring production. New ES8 deliveries also began in the last few days of June.

Following the price cut and slew of new models, we think 20,000 in monthly sales is achievable during 3Q.

Nio exited the month with ~1,500 battery swap stations.

XPeng delivered 8,620 units (+15 percent MoM; -44 percent YoY), ahead of our expectations. P7 sales increased 17 percent MoM to nearly 5,200.

Most importantly, the initial reception to the new G6 is looking increasingly positive.

Starting price will be just 210k RMB and management raised its pre-sale number to +35,000 units (vs. prior +25,000), suggesting a robust pipeline of deliveries for 3Q.

Looking ahead, we expect July can reach at least 10,000 deliveries and 15,000 in September is doable.

Zeekr delivered sales of 10,620 vehicles (+22 percent MoM; +147 percent YoY). Looking ahead, Zeekr is offering some promotions through September on the 001 (likely in response to ET5 Touring competition) including free upgrade options on exterior color, larger 100 kWh battery, dual-motor 4WD, air suspension, and/or charging credits.

In addition, the company is providing special financing offers on all models.

Recall, Zeekr is targeting 140,000 in total unit sales this year (<43,000 through 6 months so far).

Nio deliveries rebound to 10,707 units in Jun as new models bring relief

The post Deutsche Bank on China EV sales: Jun gathering momentum appeared first on CnEVPost.

For more articles, please visit CnEVPost.