BYD also registred 54 EVs, slightly up from April.

The post Chinese brands registrations in Germany: MG 1780, Great Wall 155, Nio 44 appeared first on CarNewsChina.com.

BYD also registred 54 EVs, slightly up from April.

The post Chinese brands registrations in Germany: MG 1780, Great Wall 155, Nio 44 appeared first on CarNewsChina.com.

Sales of China-made Tesla vehicles rose 2% month-on-month and 141% year-on-year this month. This was mainly due to a decline in factory output due to the coronavirus outbreak in Shanghai during the same period last year.

The post Tesla sold 77,695 Chinese-made EVs in May appeared first on CarNewsChina.com.

In January-April, CALB's power battery installations of 8.4 GWh surpassed Samsung SDI's 7.5 GWh, according to SNE Research.

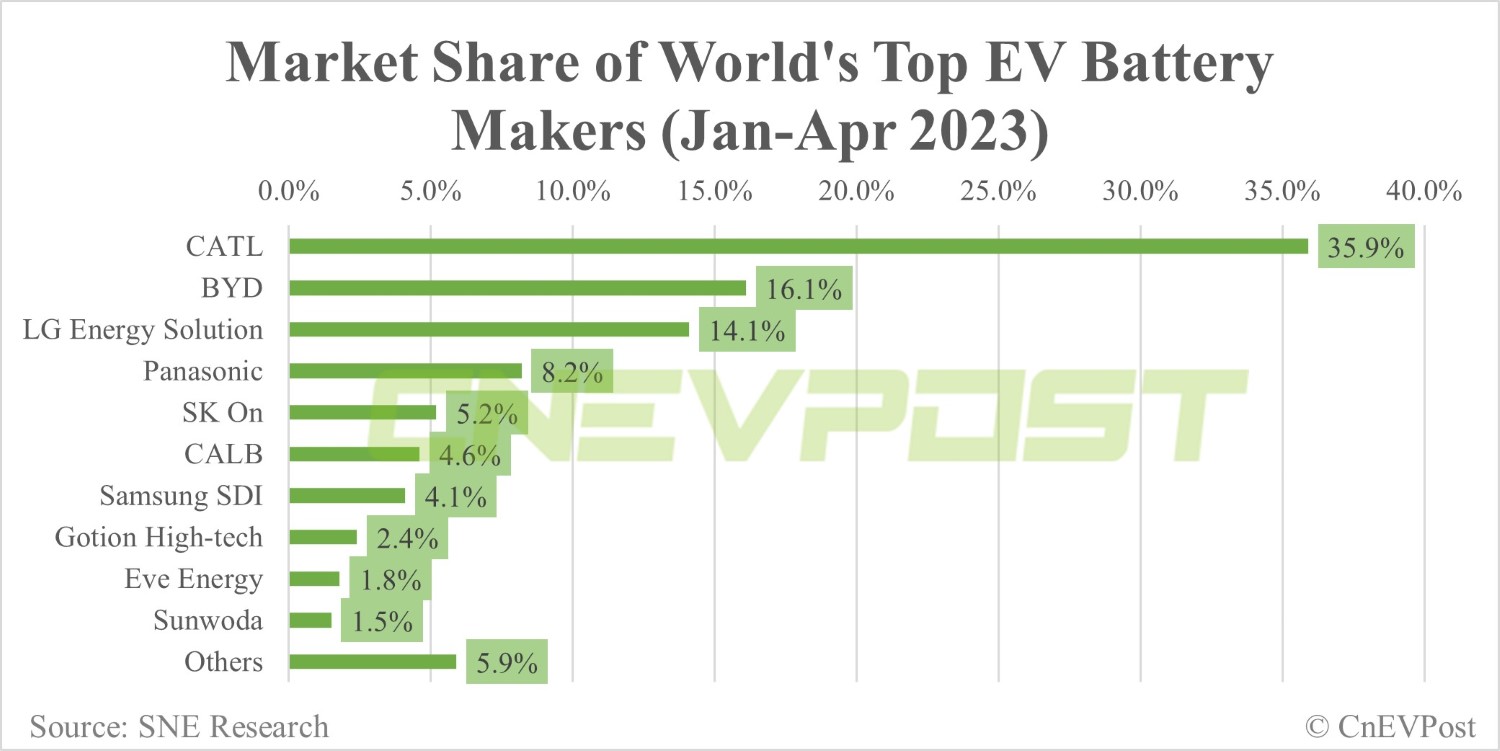

China's CATL and BYD (OTCMKTS: BYDDY) continued to be the world's two largest power battery manufacturers in January-April, the latest data show.

In January-April, global battery consumption for electric vehicles (EVs) totaled 182.5 GWh, up 49 percent from 122.5 GWh in the same period last year, according to data released today by South Korean market research firm SNE Research.

Among them, CATL installed 65.6 GWh of batteries from January to April, up 55.6 percent from 42.1 GWh in the same period last year.

The Chinese power battery giant continues to rank No. 1 in the world with a 35.9 percent share and remains the only one in the world with a market share of more than 30.0 percent.

This was higher than its 34.4 percent share in the same period last year and up from its 35.0 percent share in the January-March period.

CATL's batteries are installed in many major passenger EV models in China's domestic market, such as the Tesla Model 3, Model Y, SAIC Mulan, GAC Aion Y and NIO ET5, as well as Chinese commercial vehicle models, and continue to grow steadily, SNE Research said.

BYD installed 29.4 GWh of power batteries from January to April, up 108.3 percent from 14.1 GWh in the same period last year.

The company ranked second with a 16.1 percent share from January to April, up from 11.5 percent in the same period last year but down from 16.2 percent in January-March.

BYD has gained popularity in China's domestic market with its competitive pricing by establishing a vertically integrated supply chain management, including battery self-sufficiency and vehicle manufacturing, SNE Research said.

With the launch of the Atto3 model, BYD showed explosive growth by expanding its market share outside of China in Asia and Europe, SNE Research said.

LG Energy Solution installed 25.7 GWh of power batteries from January to April, up 49.3 percent year-on-year.

The South Korean company ranked third in the world with a 14.1 percent share, unchanged from a year ago.

Japan's Panasonic was fourth with 8.2 percent share, South Korea's SK On was fifth with 5.2 percent share and China's CALB was sixth with 4.6 percent share.

South Korea's Samsung SDI of, China's Gotion High-tech of China, Eve Energy and Sunwoda ranked seventh, eighth, ninth and tenth respectively, with shares of 4.1 percent, 2.4 percent, 1.8 percent and 1.5 percent from January to April, respectively.

It is worth noting that CALB's power battery installed base of 8.4 GWh exceeded Samsung SDI's 7.5 GWh in the January to April period.

In January-March, CALB was 5.7 GWh, lower than Samsung SDI's 6.5 GWh.

In 2023, Chinese companies are expected to enter overseas markets such as the US and Europe in preparation for a gradual decline in growth rates in China's domestic market, the largest EV market, according to SNE Research.

The European EV market, which has relatively fewer political issues than the US, is attracting attention as a strategic point for seeking to diversify the battery supply chain, the report noted.

Going forward, the share of LFP batteries in Europe is expected to increase as Chinese companies enter the European market in earnest, the report said.

CATL unveils Condensed Battery for electric aircrafts and EVs

The post Global EV battery market share in Jan-April: CATL 35.9%, BYD 16.1% appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Also EV startup Aiways registred 41 EVs.

The post Chinese brands registrations in Netherlands in May: Lynk&Co 681, MG 560, Nio 23 appeared first on CarNewsChina.com.

BYD Seagull was released at the end of April, and mass delivery began in May, with sales of 14,300 units. Its main competitor, the Wuling Bingo, sold 16,383 units in the first month (April) after its release.

The post BYD Seagull sells 14,300 units in the first month after delivery appeared first on CarNewsChina.com.

From January to May, the Qin family models sold 171,534 units and the Song family sold 216,625 units.

BYD today announced its new energy vehicle (NEV) sales for May, and later provided breakdown figures to show which of its models are the most popular.

The Qin family models sold a record 43,757 units in May, making it the highest-selling BYD model for the month. This represents a 110.85 percent year-on-year increase and a 3.68 percent increase from April.

From January to May, the Qin family models sold 171,534 units, up 42.81 percent year-on-year.

On February 10, BYD let a facelift of the plug-in hybrid sedan Qin Plus DM-i go on sale, offering five versions with a starting price range of RMB 99,800 ($$14,040) to RMB 145,800.

This is the first time BYD has made the starting price of a model with its DM-i powertrain below RMB 100,000.

The Qin family was also the highest-selling BYD model in March and April.

Song family models sold 38,014 units in May, making it the second highest-selling BYD model in May. This represents an 18.83 percent year-on-year increase and a 6.08 percent increase from April.

From January to May, Song family models sold 216,625 units, up 65.60 percent year-on-year.

The BYD brand includes the Dynasty series and the Ocean series. Song family models include the Song Pro and Song Max DM-i in the Dynasty series, and the Song Plus EV and Song Plus DM-i in the Ocean series.

In May, 13,685 units of the Dynasty series Song were sold and 24,329 units of the Ocean series Song Plus were sold.

BYD Yuan family models sold 35,815 units in May, up 168.62 percent year-on-year and down 8.54 percent from April.

From January to May, the Yuan family models sold 172,218 units, up 192.24 percent year-on-year.

The NEV maker launched the 2023 Yuan Pro on May 31 with a starting price of RMB 95,800.

BYD Dolphin sold 30,679 units in May, up 377.12 percent year-on-year and 0.71 percent from April.

From January to May, BYD Dolphin sold 131,708 units, an increase of 173.61 percent year-on-year.

BYD Han family models sold 20,387 units in May, down 14.82 percent year-on-year, but up 42.28 percent from April.

From January to May, the Han family sold 71,784 units, up 63.72 percent year-on-year.

On March 16, BYD let the 2023 Han EV go on sale. On May 18, BYD let the Han DM-i and Han DM-p facelift models go on sale.

BYD Seagull sold 14,300 units in May. The model was launched on April 26 with a starting price of RMB 73,800, making it the cheapest BYD model.

BYD Seagull sold 1,500 units in April.

BYD Tang sold 11,871 units in May, up 40.50 percent year-on-year and up 0.95 percent from April.

From January to May, the Tang sold 56,682 units, up 18.85 percent year-on-year.

BYD made the 2023 Tang DM-i available on March 16 with a starting price of RMB 209,800.

BYD Chaser 05 sold 10,457 units in May, up 129.42 percent year-on-year and 94.37 percent units from April.

From January to May, 29,684 units of this model were sold.

The BYD Frigate 07 sold 10,005 units in May, flat from the 10,003 units sold in April. From January to May, the model sold 39,630 units.

The BYD Seal sold 8,079 units in May, up 30.05 percent from April. The model sold 34,663 units from January to May.

On May 10, BYD officially launched the revamped version of the Seal with a starting price of RMB 23,000 lower than the previous model on sale.

BYD sold 240,220 NEVs in May, including 239,092 new energy passenger vehicles, and 1,128 new energy commercial vehicles.

Its Dynasty series passenger cars sold 125,515 units in May, and the Ocean series sold 102,572 units.

($1 = RMB 7.1063)

BYD sells record 240,220 NEVs in May, surpasses 1 million for the year

The post BYD May sales breakdown: Qin 43,757 units, Song 38,014 units appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Among them, pure electric vehicles, including 119,603 pure electric vehicles. BYD sold 10,203 vehicles outside China.

The post BYD sold 240,220 EVs and PHEVs in May, breaking historical records appeared first on CarNewsChina.com.

BYD aims to sell at least 3 million NEVs this year.

BYD (OTCMKTS: BYDDY) saw record new energy vehicle (NEV) sales in May, putting it over the 1 million unit mark for sales in the year.

The NEV giant sold 240,220 NEVs in May, up 108.99 percent from 114,943 units a year ago and up 14.23 percent from 210,295 units in April, according to data released today.

The company discontinued production and sales of vehicles powered entirely by internal combustion engines in March last year to focus on producing plug-in hybrids and pure electric vehicles.

BYD's NEVs include passenger cars as well as commercial vehicles, with sales of 239,092 new energy passenger cars in May, up 109.39 percent from 114,183 units in the same month last year and up 14.14 percent from 209,467 units in April.

BYD's new energy commercial vehicles sold 1,128 units in May, up 48.42 percent from 760 units in the same month last year and up 36.23 percent from 828 units in April.

Among these passenger NEVs, battery electric vehicles (BEVs) sold 119,603 units, up 124.19 percent from 53,349 units a year ago and up 14.6 percent from 104,364 units in March.

Its passenger plug-in hybrid vehicles (PHEVs) were 119,489 units, up 96.42 percent from 60,834 units in the same month last year and up 13.69 percent from 105,103 units in April.

In May, BYD sold 10,203 NEVs in overseas markets, down 31.19 percent from 14,827 units in April. The company first announced overseas sales figures for NEVs in July 2022.

In addition to being China's largest NEV company, BYD is also the country's second-largest manufacturer of power batteries.

BYD's installed power and storage battery capacity in May was about 11.489 GWh, up 85.22 percent from 6.203 GWh in the same month last year and up 15.42 percent from 9.954 GWh in April.

From January to May, BYD's NEV sales exceeded the 1-million-unit mark at 1,002,591 units, up 348.11 percent from 507,314 units in the same period last year.

Its passenger NEV sales for the period were 996,476 units, up 358.15 percent from the same period last year.

BYD aims to sell at least 3 million vehicles this year and strives to reach 3.6 million, the company's chairman and president Wang Chuanfu said at an investor conference in late March.

BYD aims to become China's No. 1 automaker by the end of this year, Wang said at the time.

To achieve its goal of selling 3 million NEVs for the year, BYD would need to sell an average of about 285,000 vehicles each month for the next seven months.

Musk once laughed at BYD, but now thinks 'their cars are highly competitive'

The post BYD sells record 240,220 NEVs in May, surpasses 1 million for the year appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Yuan Pro EV is a small five-seat electric SUV launched by BYD with a length of 4375mm and a wheelbase of 2535mm.

The post New BYD Yuan Pro launched, starting at 13,400 USD (95,800 RMB) appeared first on CarNewsChina.com.

The Yuan family of models sold 39,160 units in April, making it the second highest-selling BYD model for the month. | BYDDY.US | BYD HK

(Image credit: BYD)

BYD (OTCMKTS: BYDDY) today officially launched the 2023 Yuan Pro, a compact SUV originally rolled out by BYD in March 2021.

The improved version of the Yuan Pro is offered in three versions with starting prices of RMB 95,800 ($13,500), RMB 105,800 and RMB 113,800 respectively.

BYD started the pre-sale for the 2023 Yuan Pro on April 7, when the pre-sale prices for these three versions were RMB 99,800, RMB 109,800 and RMB 119,800 respectively.

Compared with the pre-sales, the launch prices of the three versions of the 2023 Yuan Pro has been reduced by RMB 4,000, RMB 4,000 and RMB 6,000 respectively.

The model's length and height are 4,375 mm, 1,785 mm and 1,680 mm respectively, with a wheelbase of 2,535 mm.

It continues the Dragon Face 3.0 design language of the previously available model.

The 2023 Yuan Pro is based on the BYD e-Platform 3.0 and features an electric motor with a maximum power of 70 kW and a maximum torque of 180 Nm, accelerating from 0 to 50 km/h in 4.9 seconds.

The car offers two range versions, with a CLTC range of 320 km and 401 km, respectively. It is equipped with a lithium iron phosphate battery pack with a capacity of 38 kWh and 47.04 kWh, respectively.

The 2023 BYD Yuan Pro supports DC fast charging, which can replenish energy from 30 percent to 80 percent in 30 minutes.

The previously available BYD Yuan Pro was launched on March 21, 2021, when two versions were offered at a subsidized price of RMB 121,300 and RMB 131,400, respectively.

China's purchase subsidies for new energy vehicles (NEVs) end at the end of 2022, and the country's purchase tax exemption for such models was extended until the end of this year.

BYD sold 210,295 NEVs in April, up 98.31 percent from 106,042 units in the same month last year and up 1.55 percent from 207,080 units in March, according to data released on May 2.

Yuan family models sold 39,160 units in April, the second-highest-selling BYD model for the month, according to data monitored by CnEVPost. This represents a 158.18 percent year-on-year increase, but a 3.07 percent decrease from March.

The Yuan family of models includes the Yuan Pro as well as the Yuan Plus, for which breakdown sales figures are not available.

The Qin family of models sold a record 42,202 units in April, making it the highest-selling BYD model for the month.

($1 = 7.1036 RMB)

Musk once laughed at BYD, but now thinks 'their cars are highly competitive'

The post BYD launches 2023 Yuan Pro SUV with prices starting at $13,500 appeared first on CnEVPost.

For more articles, please visit CnEVPost.