In Two Weeks, Tesla, Ford, And GM May Have Killed The CCS1 Charging Standard

NIO and XPeng both saw net losses in the first quarter, while Li Auto posted net income.

With the release of NIO's (NYSE: NIO) financial results, the trio of US-listed Chinese electric vehicles all reported first-quarter earnings.

With this article, we try to give readers a quick look at how the financials of NIO, XPeng (NYSE: XPEV), and Li Auto (NASDAQ: LI) compare in a few charts.

It should be noted that NIO and XPeng currently offer only battery electric vehicles (BEVs), a fast-growing but small market in China that currently accounts for about 30 percent of all passenger car sales.

Li Auto's full range of vehicles are extended-range electric vehicles (EREVs), essentially plug-in hybrids, targeting a much larger market.

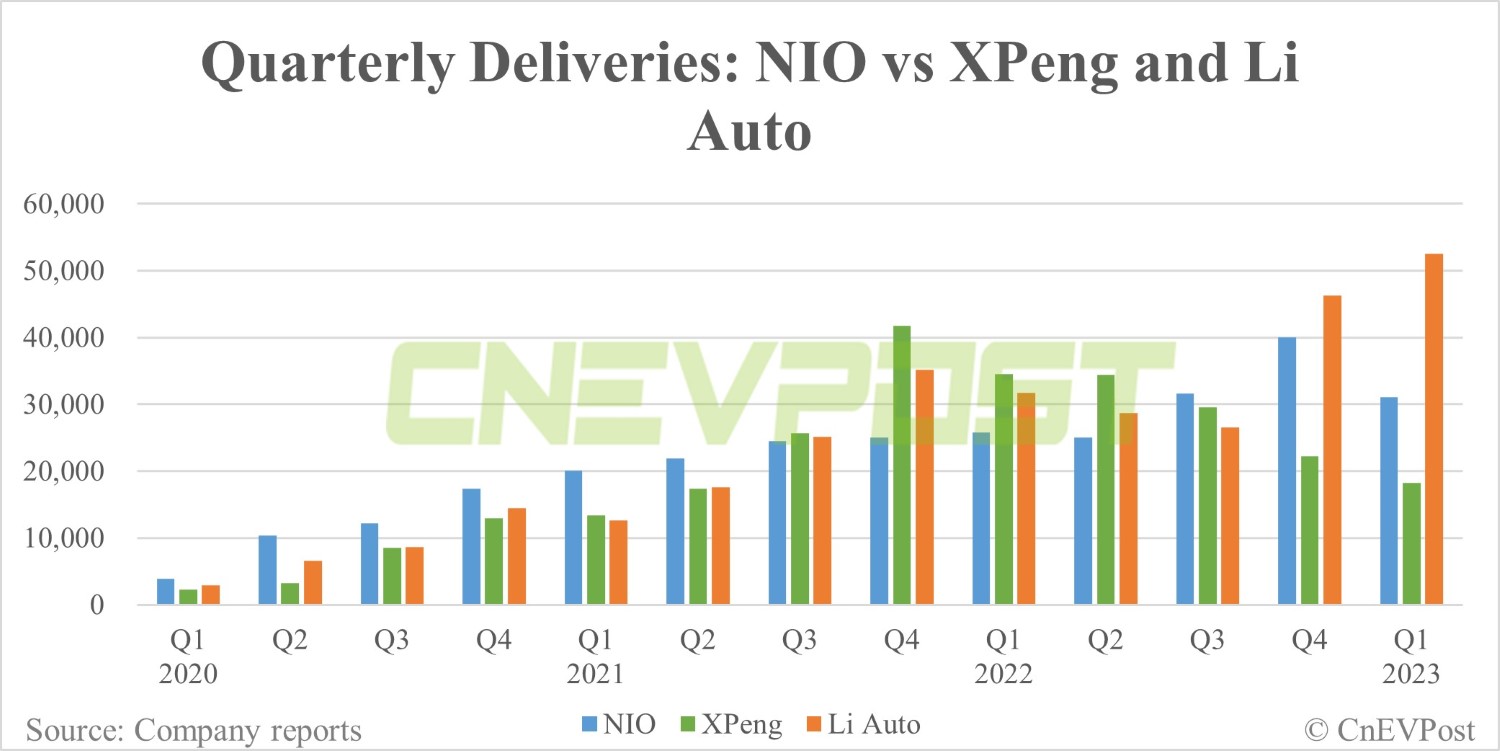

In terms of quarterly deliveries, all three companies are essentially continuing to grow in 2020-2021.

In the first quarter of 2022 so far, NIO and XPeng have had a weak delivery performance, while Li Auto's has continued to grow, especially in the last two quarters.

In the first quarter of the year, Li Auto delivered 52,584 vehicles, while NIO and XPeng delivered 31,041 and 18,230, respectively.

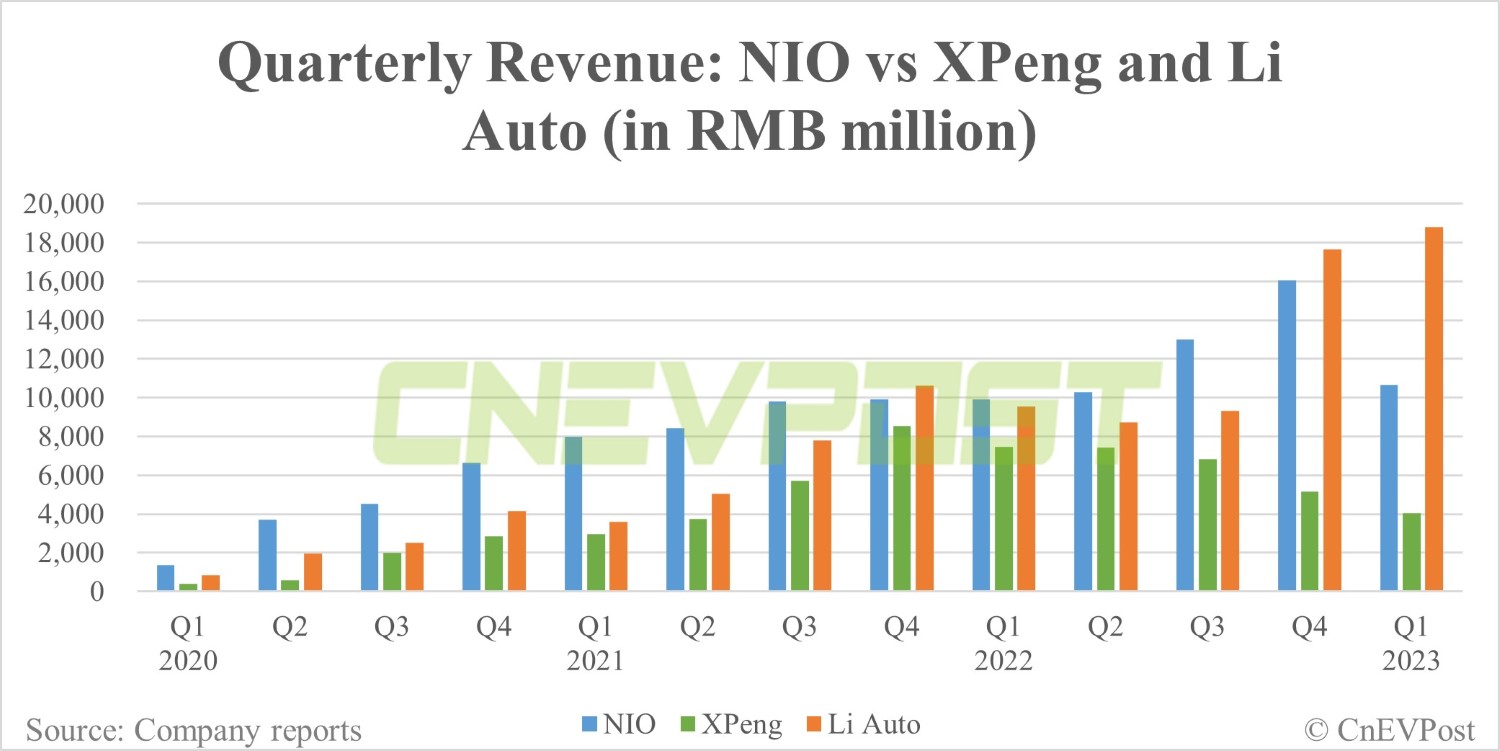

Since all three companies derive their revenue primarily from car sales, the change in deliveries essentially corresponds to the change in revenue.

In the first quarter, Li Auto's revenue was RMB 18.8 billion, NIO was RMB 10.7 billion and XPeng was RMB 4.03 billion.

Their gross margins have been relatively stable over the past two years, with NIO and XPeng declining significantly over the past two quarters due to promotional activities.

Li Auto's gross margin has rebounded over the past two quarters after seeing a decline in the third quarter of last year.

NIO and XPeng has been continuing to face net losses while Li Auto has been profitable for multiple quarters.

In the first quarter, NIO had a net loss of RMB 4.74 billion, XPeng had a net loss of RMB 2.34 billion, and Li Auto achieved net income of RMB 934 million.

NIO Q1 earnings miss expectations, gross margin drops to 1.5%

The post Q1 earnings: How does NIO compare to XPeng and Li Auto? appeared first on CnEVPost.

For more articles, please visit CnEVPost.

In the first five months of this year, the top 3 EV manufacturers in Thailand were BYD, MG, and Tesla and Neta. They accounted for 38.6%, 16.7% and 16.0% of the Thai EV market, respectively.

The post BYD retains the EV sales champion title in Thailand for six months appeared first on CarNewsChina.com.

NIO reported revenue of RMB 10.68 billion in the first quarter, below market expectations of RMB 12.275 billion, compared to RMB 9.911 billion in the same period last year.

Previous data showed that NIO delivered 31,041 vehicles in the first quarter, slightly above the lower end of the guidance range of 31,000 to 33,000 vehicles.

NIO's previous revenue guidance for the first quarter was between RMB 10.93 billion and RMB 11.54 billion.

Below is its press release, as the CnEVPost article is being updated.

otal revenues in the first quarter of 2023 were RMB10,676.5 million (US$1,554.6 million), representing an increase of 7.7% from the first quarter of 2022 and a decrease of 33.5% from the fourth quarter of 2022.

Vehicle sales in the first quarter of 2023 were RMB9,224.5 million (US$1,343.2 million), representing a decrease of 0.2% from the first quarter of 2022 and a decrease of 37.5% from the fourth quarter of 2022. The decrease in vehicle sales over the first quarter of 2022 was mainly due to lower average selling price as a result of higher proportion of ET5 and 75 kWh standard-range battery pack deliveries, partially offset by an increase in delivery volume.

The decrease in vehicle sales over the fourth quarter of 2022 was mainly due to a decrease in delivery volume, and lower average selling price as a result of higher proportion of ET5 and 75 kWh standard-range battery pack deliveries.

Other sales in the first quarter of 2023 were RMB1,452.0 million (US$211.4 million), representing an increase of 117.8% from the first quarter of 2022 and an increase of 11.3% from the fourth quarter of 2022.

The increase in other sales over the first quarter of 2022 was mainly due to the increase in sales of accessories, provision of repair and maintenance services, provision of auto financing services, sales of used cars and provision of power solutions, as a result of continued growth of our users.

The increase in other sales over the fourth quarter of 2022 was mainly due to the increase in provision of auto financing services, sales of accessories, provision of repair and maintenance services, provision of power solutions and sales of used cars, as a result of continued growth of our users, and partially offset by a decrease in revenue from rendering of research and development services.

Cost of Sales and Gross Margin

Cost of sales in the first quarter of 2023 was RMB10,514.2 million (US$1,531.0 million), representing an increase of 24.2% from the first quarter of 2022 and a decrease of 31.9% from the fourth quarter of 2022.

The increase in cost of sales over the first quarter of 2022 was mainly driven by the increase in (i) delivery volume, and (ii) cost from the sales of accessories, provision of repair and maintenance services, sales of used cars and provision of power solutions, associated with increased vehicle sales and expanded power and service network. The decrease in cost of sales over the fourth quarter of 2022 was mainly attributed to (i) the decrease in delivery volume, (ii) the decrease in average material cost per vehicle as a result of higher proportion of ET5 and 75 kWh standard-range battery pack deliveries, and (iii) the inventory provisions, accelerated depreciation on production facilities, and losses on purchase commitments related to the previous generation of ES8, ES6 and EC6 in the fourth quarter of 2022.

Gross profit in the first quarter of 2023 was RMB162.3 million (US$23.6 million), representing a decrease of 88.8% from the first quarter of 2022 and a decrease of 73.9% from the fourth quarter of 2022.

Gross margin in the first quarter of 2023 was 1.5%, compared with 14.6% in the first quarter of 2022 and 3.9% in the fourth quarter of 2022. The decrease of gross margin from the first quarter of 2022 and the fourth quarter of 2022 was mainly attributed to the decreased vehicle margin.

Vehicle margin in the first quarter of 2023 was 5.1%, compared with 18.1% in the first quarter of 2022 and 6.8% in the fourth quarter of 2022. The decrease in vehicle margin from the first quarter of 2022 was mainly attributed to changes in product mix and increased battery cost per unit.

The decrease in vehicle margin from the fourth quarter of 2022 was mainly due to (i) changes in product mix, and (ii) increased promotion discount for the previous generation of ES8, ES6 and EC6, which were partially offset by (iii) the inventory provisions, accelerated depreciation on production facilities, and losses on purchase commitments for the previous generation of ES8, ES6 and EC6 in the fourth quarter of 2022.

Operating Expenses

Research and development expenses in the first quarter of 2023 were RMB3,075.6 million (US$447.8 million), representing an increase of 74.6% from the first quarter of 2022 and a decrease of 22.7% from the fourth quarter of 2022.

Excluding share-based compensation expenses, research and development expenses (non-GAAP) were RMB2,711.6 million (US$394.8 million), representing an increase of 79.1% from the first quarter of 2022 and a decrease of 23.7% from the fourth quarter of 2022. The increase in research and development expenses over the first quarter of 2022 was mainly attributed to the increased personnel costs in research and development functions and the increased share-based compensation expenses recognized in the first quarter of 2023.

The decrease in research and development expenses over the fourth quarter of 2022 reflected fluctuations due to different design and development stages of new products and technologies.

Selling, general and administrative expenses in the first quarter of 2023 were RMB2,445.9 million (US$356.2 million), representing an increase of 21.4% from the first quarter of 2022 and a decrease of 30.7% from the fourth quarter of 2022.

Excluding share-based compensation expenses, selling, general and administrative expenses (non-GAAP) were RMB2,239.3 million (US$326.1 million), representing an increase of 24.3% from the first quarter of 2022 and a decrease of 31.2% from the fourth quarter of 2022.

The increase in selling, general and administrative expenses over the first quarter of 2022 was mainly attributed to (i) the increase in personnel costs related to sales and general corporate functions, and (ii) the increase in expenses related to the Company's sales and service network expansion. The decrease in selling, general and administrative expenses over the fourth quarter of 2022 was mainly due to the decrease in sales and marketing activities and professional services.

Loss from Operations

Loss from operations in the first quarter of 2023 was RMB5,111.8 million (US$744.3 million), representing an increase of 133.6% from the first quarter of 2022 and a decrease of 24.1% from the fourth quarter of 2022. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB4,522.4 million (US$658.5 million) in the first quarter of 2023, representing an increase of 163.6% from the first quarter of 2022 and a decrease of 24.8% from the fourth quarter of 2022.

Net Loss and Earnings Per Share/ADS

Net loss in the first quarter of 2023 was RMB4,739.5 million (US690.1 million), representing an increase of 165.9% from the first quarter of 2022 and a decrease of 18.1% from the fourth quarter of 2022. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB4,150.1 million (US604.3 million) in the first quarter of 2023, representing an increase of 216.9% from the first quarter of 2022 and a decrease of 18.1% from the fourth quarter of 2022.

Net loss attributable to NIO's ordinary shareholders in the first quarter of 2023 was RMB 4,803.6 million (US$699.5 million), representing an increase of 163.2% from the first quarter of 2022 and a decrease of 17.8% from the fourth quarter of 2022. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO's ordinary shareholders (non-GAAP) was RMB 4,141.8 million (US$603.1 million) in the first quarter of 2023.

Basic and diluted net loss per ordinary share/ADS in the first quarter of 2023 were both RMB2.91 (US$0.42), compared with RMB1.12 in the first quarter of 2022 and RMB3.55 in the fourth quarter of 2022. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per share/ADS (non-GAAP) were both RMB2.51 (US$0.36), compared with RMB0.79 in the first quarter of 2022 and RMB3.07 in the fourth quarter of 2022.

Balance Sheet

Balance of cash and cash equivalents, restricted cash, short-term investment and long-term time deposits was RMB37.8 billion (US$5.5 billion) as of March 31, 2023.

Business Outlook

For the second quarter of 2023, the Company expects:

Deliveries of vehicles to be between 23,000 and 25,000 vehicles, representing a decrease of approximately 8.2% to 0.2% from the same quarter of 2022.

Total revenues to be between RMB8,742 million (US$1,273 million) and RMB9,370 million (US$1,364 million), representing a decrease of approximately 15.1% to 9.0% from the same quarter of 2022.

The post NIO reports weaker-than-expected Q1 earnings, gross margin falls to 1.5% appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Filed under: Green,Motorsports,Honda,First Drives,Technology,Concept Cars,Electric

Continue reading Honda eGX Racing Kart Concept First Drive: Karting’s electric future looks bright

Honda eGX Racing Kart Concept First Drive: Karting’s electric future looks bright originally appeared on Autoblog on Fri, 9 Jun 2023 06:00:00 EDT. Please see our terms for use of feeds.

Permalink | Email this | CommentsEve Energy will build a project for large cylindrical batteries for passenger cars in Hungary over a four-year construction period.

(Image credit: Eve Energy)

Chinese lithium battery maker Eve Energy plans to invest more than $1 billion in a battery plant in Hungary to expand its presence in overseas markets.

Eve Energy's board of directors has given its subsidiary EVE Power Hungary Kft the go-ahead to build a large cylindrical battery project for passenger cars in Hungary, with an investment amount not exceeding RMB 9.97 billion ($1.4 billion).

The project is located in Debrecen, Hungary, and the construction period is four years, according to an announcement yesterday by the Shenzhen-listed company.

The project will help improve the company's global industrial layout and promote the smooth progress of its overseas business, the announcement said.

It will also facilitate the company's rapid response to local demand for new energy vehicle (NEV) power batteries from key customers in Hungary and take on more orders from customers in Europe, Eve Energy said.

EVE Power Hungary signed an agreement on May 9 with Debreceni, a subsidiary of Hungary's Debrecen government, to purchase land owned by the latter in the city's northwest industrial zone for the production of cylindrical power batteries, according to a Shenzhen Stock Exchange announcement at the time.

The land has an area of 45 hectares and the purchase price is 22.5 euros per square meter plus VAT, for a total price of about 12.86 million euros, according to the announcement.

The deal will meet the company's need for production land for future growth and further scale up its production capacity for power and energy storage batteries, Eve Energy said.

Eve Energy's announcement provided no further information, though the move appears to be in preparation for supplying BMW.

On September 9, 2022, Eve Energy announced that it had finalized a battery supply relationship with BMW Group to supply large cylindrical lithium-ion cells for the latter's Neue Klasse line of models.

BMW also said at the time in a post on its official WeChat account that it had awarded contracts worth more than 10 billion euros to CATL and Eve Energy to meet the demand for cells for the new generation of models.

The two partners will each build two battery plants in China and Europe, each with an annual capacity of 20 GWh, BMW said at the time, adding that it will also look for partners to build two more battery plants in the North American Free Trade Area.

Eve Energy is one of China's largest battery makers, with 1.33 GWh of batteries installed in May, ranking fourth with a 4.71 percent share, according to the China Automotive Battery Innovation Alliance (CABIA) earlier today.

($1 = RMB 7.1227)

China EV battery installations in May: BYD extends lead in LFP market

The post Eve Energy to invest up to $1.4 billion in Hungary battery plant appeared first on CnEVPost.

For more articles, please visit CnEVPost.