Volvo Tripled All-Electric Car Sales In May 2023

Filed under: Earnings/Financials,Government/Legal,Green,Truck,Electric

Continue reading EV maker Lordstown plans to sue Foxconn over funding dispute

EV maker Lordstown plans to sue Foxconn over funding dispute originally appeared on Autoblog on Fri, 9 Jun 2023 08:50:00 EDT. Please see our terms for use of feeds.

Permalink | Email this | CommentsAccording to the data released by the China Passenger Car Association (CPCA), the Chinese market witnessed the sale of 1.742 million new cars in May 2023. This represents a 7% increase compared to the previous month. Notably, among these sales, 388,000 were electric vehicles (EVs), and 192,000 were plug-in hybrid electric vehicles (PHEVs), collectively known […]

The post Top-selling cars in May 2023 in China – BYD first, Volkswagen second, Toyota third appeared first on CarNewsChina.com.

(Image credit: CnEVPost)

NIO is holding a first-quarter earnings analyst call and this article will provide key highlights from the call, with the latest being at the top.

NIO is confident that the gross margin will return to double digits in the third quarter and to 15 percent in the fourth quarter.

NIO ES6's locked-in orders have met expectations and the test drive conversion rate is the highest of any model.

NIO is targeting 10,000 units of the new ES6 for both production and delivery in July.

The other models besides ES6 still have a chance to achieve the target of 20,000 units delivered per month, except that the ET5 faces a greater challenge after the withdrawal of national subsidies.

NIO will launch ET5 Touring on June 15.

The sub-brand ALPS is still on track and will start delivering products in the second half of next year. NIO will be managed more carefully in terms of pace and efficiency.

The development of models for NIO's second-generation platform has been completed, and now we need to think about how the marketing team can better sell the cars.

NIO's goal is to obtain a fair share of the current eight vehicles in their segments.

NIO Q1 earnings miss expectations, gross margin drops to 1.5%

The post NIO Q1 earnings call: Live text updates appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Filed under: Earnings/Financials,Green,GM,Tesla,Electric

Continue reading Tesla stock jumps on EV charging tie-up with GM

Tesla stock jumps on EV charging tie-up with GM originally appeared on Autoblog on Fri, 9 Jun 2023 08:29:00 EDT. Please see our terms for use of feeds.

Permalink | Email this | Comments

NIO and XPeng both saw net losses in the first quarter, while Li Auto posted net income.

With the release of NIO's (NYSE: NIO) financial results, the trio of US-listed Chinese electric vehicles all reported first-quarter earnings.

With this article, we try to give readers a quick look at how the financials of NIO, XPeng (NYSE: XPEV), and Li Auto (NASDAQ: LI) compare in a few charts.

It should be noted that NIO and XPeng currently offer only battery electric vehicles (BEVs), a fast-growing but small market in China that currently accounts for about 30 percent of all passenger car sales.

Li Auto's full range of vehicles are extended-range electric vehicles (EREVs), essentially plug-in hybrids, targeting a much larger market.

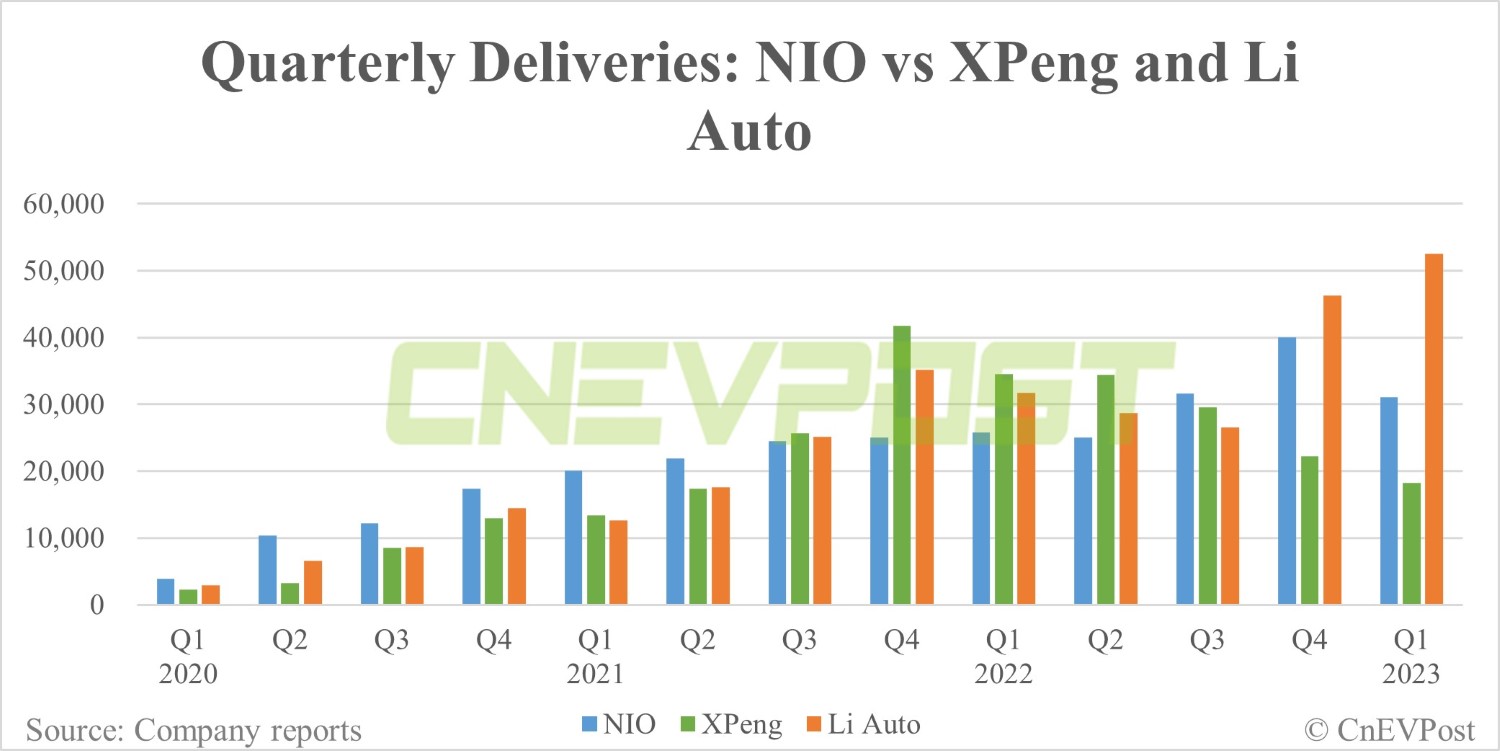

In terms of quarterly deliveries, all three companies are essentially continuing to grow in 2020-2021.

In the first quarter of 2022 so far, NIO and XPeng have had a weak delivery performance, while Li Auto's has continued to grow, especially in the last two quarters.

In the first quarter of the year, Li Auto delivered 52,584 vehicles, while NIO and XPeng delivered 31,041 and 18,230, respectively.

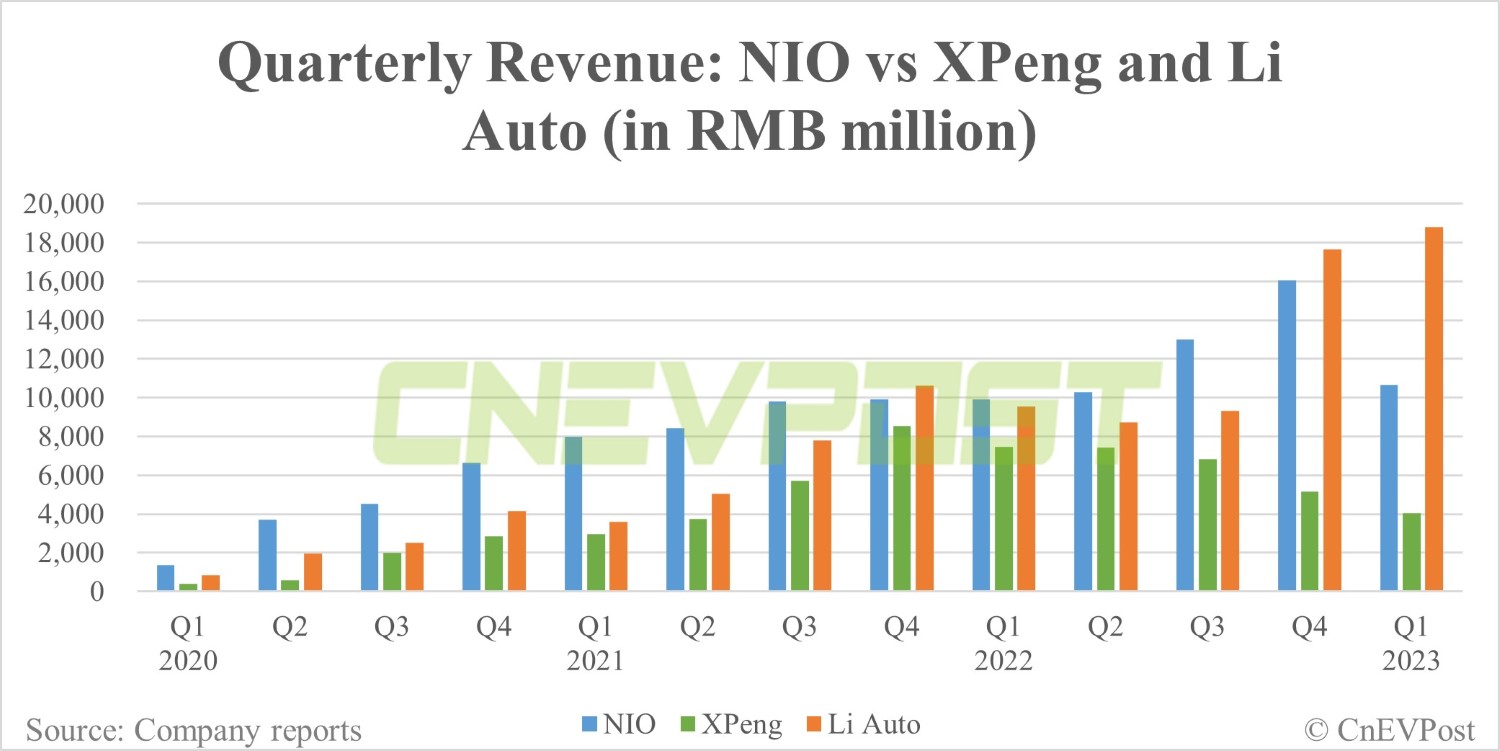

Since all three companies derive their revenue primarily from car sales, the change in deliveries essentially corresponds to the change in revenue.

In the first quarter, Li Auto's revenue was RMB 18.8 billion, NIO was RMB 10.7 billion and XPeng was RMB 4.03 billion.

Their gross margins have been relatively stable over the past two years, with NIO and XPeng declining significantly over the past two quarters due to promotional activities.

Li Auto's gross margin has rebounded over the past two quarters after seeing a decline in the third quarter of last year.

NIO and XPeng has been continuing to face net losses while Li Auto has been profitable for multiple quarters.

In the first quarter, NIO had a net loss of RMB 4.74 billion, XPeng had a net loss of RMB 2.34 billion, and Li Auto achieved net income of RMB 934 million.

NIO Q1 earnings miss expectations, gross margin drops to 1.5%

The post Q1 earnings: How does NIO compare to XPeng and Li Auto? appeared first on CnEVPost.

For more articles, please visit CnEVPost.