Daily Archive: June 5, 2023

YouTuber Explains Why He Got Rid Of His Volkswagen ID.4

Kawasaki Presents The Noslisu Electric Cargo Bike In Japan

NIO Q1 earnings preview: Struggling along for another quarter

Deutsche Bank expects NIO to report soft results for the first quarter, with downside risk to margins, though some relief in on the way.

NIO (NYSE: NIO) will report first-quarter unaudited financial results on Friday, June 9, before the US markets open. As usual, Deutsche Bank analyst Edison Yu's team provided their preview.

"NIO is suffering from weaker-than-expected demand and is facing its greatest adversity since nearly going bankrupt in 2020," the team said in a research note sent to investors today titled "Struggling along for another quarter."

The team expects NIO to report soft results in the first quarter, with downside risk to margins, and a very weak outlook for sales, and margins in the second quarter.

First quarter earnings

Previous data showed that NIO delivered 31,041 vehicles in the first quarter, slightly above the lower end of the guidance range of 31,000 to 33,000 vehicles.

NIO's previous revenue guidance for the first quarter was between RMB 10.93 billion and RMB 11.54 billion, implying year-on-year growth of about 10.2 percent to 16.5 percent.

Yu's team expects NIO to report revenue of RMB 10.9 billion in the first quarter, with a gross margin of 2.5 percent and adjusted earnings per share of RMB -3.07.

This compares to the current analyst consensus estimates of RMB 11.7 billion, 7.4 percent, and RMB -2.66, respectively, in a Bloomberg survey.

Looking ahead, Yu's team expects NIO to deliver 21,000-23,000 units in the second quarter.

NIO delivered only 12,813 units in April and May combined due to very low demand for the ET7 and ES7, the team noted.

The EV maker delivered 6,155 vehicles in May, down 7.55 percent from 6,658 in April, according to data released on June 1.

Why the weak sales?

While production and supply chain issues appear to be resolved, underlying demand for NIO's premium BEVs has been disappointing as customers opt for gasoline models from German luxury carmakers BMW, Mercedes-Benz, Audi and Li Auto EREVs, Yu's team said.

The team attributed NIO's recent weak sales to 3 main factors. The following is from their research note:

1. NIO's pricing is the highest amongst the start-ups and premium BEV demand has been generally weak across the board.

2. The premium segment appears to be electrifying more slowly which may be counter-intuitive to those outside China. Based on our analysis of the premium SUV market (>300k RMB), the BEV mix is only 12% YTD, compared with PHEV (includes EREV) at 18%, leaving 70% for ICE.

This compares with the overall market that is 21% BEV and 10% PHEV, showing customer preferences are quite different depending on the sub-segment.

Our read is the EREV value position is resonating with a much broader audience than anticipated which Li Auto has done a very effective job at maximizing.

3. We believe NIO's brand appeal has hit a wall of sorts as it is struggling to get momentum outside of Shanghai (and surrounding provinces) and also beyond finance/tech social circles.

To illustrate this, we look at the performance of NIO's best-selling ET5. Nearly 40% of sales mix comes from this region and ET5 sells quite poorly in the south despite in theory having the broadest appeal amongst NIO's offerings.

Moreover, based on our channel checks, affluent older customers simply are not buying into the brand (yet) and still prefer traditional BBA cars.

Management will need to figure out ways to augment the appeal of its unique services such as battery swapping. For existing customers, the usage is actually quite high, having set records during recent holiday (69k swaps in one day or ~20% of car parc).

Some relief on the way

NIO officially launched the new ES6 -- the best-selling NIO SUV in history -- in China on May 24, and deliveries began the same night.

In addition to the new ES6, NIO will also begin deliveries of the new ES8 and the ET5 Touring, a derivative of the ET5 sedan, this month.

NIO's deliveries in June will get a boost from a full month of new ES6 deliveries and partial contributions from the ET5 Touring, Yu's team said.

The new ES6 starts at RMB 368,000, higher than expected, as many potential buyers are comparing it to the Li Auto Li L7, which starts at RMB 319,800, the team said.

(Image credit: CnEVPost)

For the ET5 Touring, the team expects pricing to be at RMB 335,000 - RMB 345,000, slightly higher than the regular ET5.

NIO management aims to capitalize on the success of the Zeekr 001, which proves there is a sizable local market for luxury sport EV wagons, the team said.

Yu's team expects NIO to see only a minimal improvement on vehicle margins in the second quarter.

"While lower battery input costs should help by at least 1-2% sequentially along with phasing out of aggressive promotional activity on first-gen 866 models, this will be partially offset by lack of overhead absorption/higher D&A as overall volume in 2Q will be down materially compared with 1Q," the team wrote .

As sales improve in the second half of the year, auto margins should return to double digits, the team said.

On the operating cost side, with sales under so much pressure, Yu's team suspects NIO management may be forced to show some level of restraint.

"We are skeptical NIO can achieve 'core' breakeven in 4Q23 and overall breakeven in 2024," the team wrote.

Also, cash burn will intensify due to declining deliveries, similar to what XPeng is experiencing, the team said, adding that they suspect NIO management will roll back its previous RMB 10 billion capex outlook.

Notably, the team remains bullish on the company's prospects, despite many investors have lost patience after multiple sales and margin disappointments.

"We think the stock is already embedding in a very negative path forward and we reiterate NIO's longer-term strategy of having multiple brands, holistic charging infrastructure, and an aspirational ecosystem can still ultimately win out once the dust settles on the EV wars," The team wrote.

The post NIO Q1 earnings preview: Struggling along for another quarter appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Baojun Yep considers introducing EREV model, enabling small ICE generator to be fitted after delivery

Pure EV range is 303 km CLTC. Fuel engine would add additional 80km of range.

The post Baojun Yep considers introducing EREV model, enabling small ICE generator to be fitted after delivery appeared first on CarNewsChina.com.

Tesla sold 77,695 Chinese-made EVs in May

Sales of China-made Tesla vehicles rose 2% month-on-month and 141% year-on-year this month. This was mainly due to a decline in factory output due to the coronavirus outbreak in Shanghai during the same period last year.

The post Tesla sold 77,695 Chinese-made EVs in May appeared first on CarNewsChina.com.

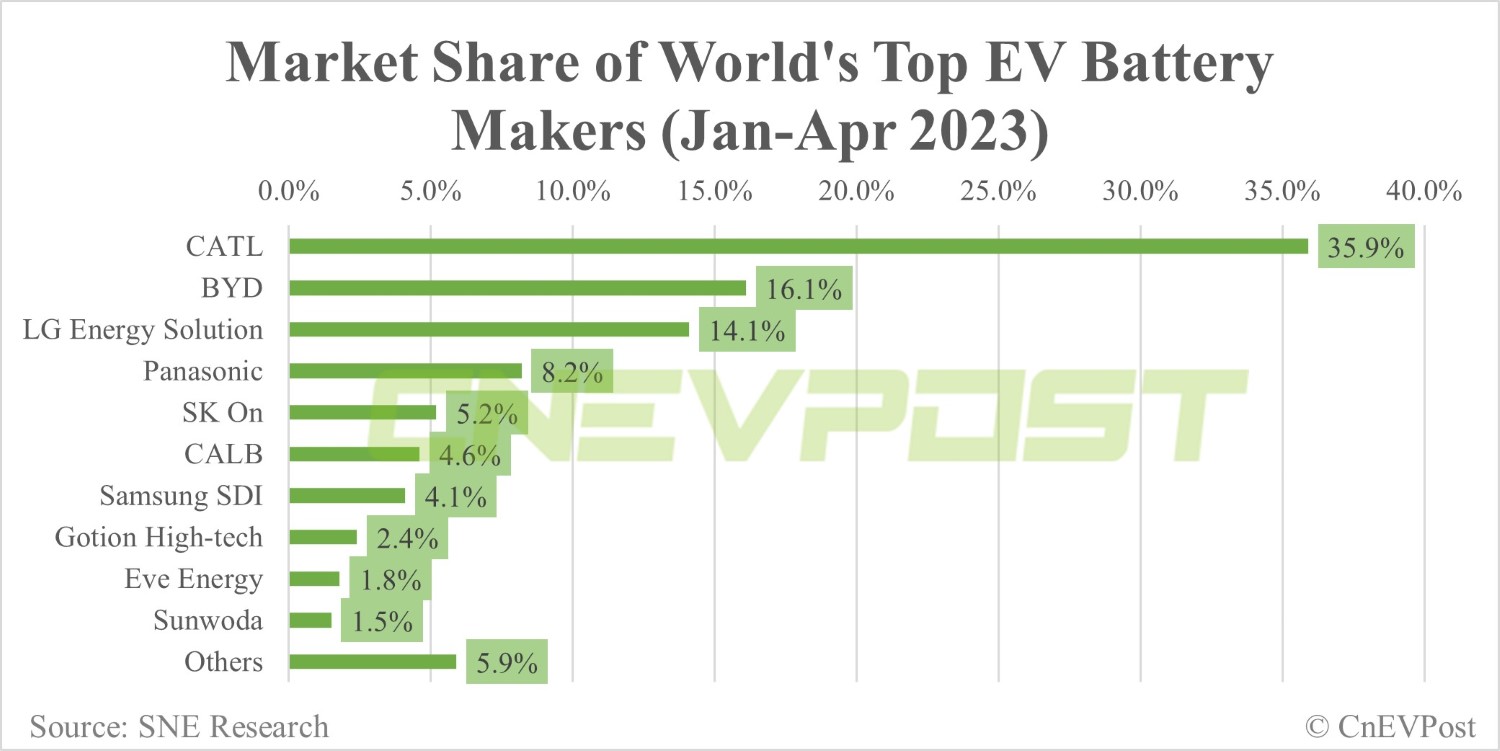

Global EV battery market share in Jan-April: CATL 35.9%, BYD 16.1%

In January-April, CALB's power battery installations of 8.4 GWh surpassed Samsung SDI's 7.5 GWh, according to SNE Research.

China's CATL and BYD (OTCMKTS: BYDDY) continued to be the world's two largest power battery manufacturers in January-April, the latest data show.

In January-April, global battery consumption for electric vehicles (EVs) totaled 182.5 GWh, up 49 percent from 122.5 GWh in the same period last year, according to data released today by South Korean market research firm SNE Research.

Among them, CATL installed 65.6 GWh of batteries from January to April, up 55.6 percent from 42.1 GWh in the same period last year.

The Chinese power battery giant continues to rank No. 1 in the world with a 35.9 percent share and remains the only one in the world with a market share of more than 30.0 percent.

This was higher than its 34.4 percent share in the same period last year and up from its 35.0 percent share in the January-March period.

CATL's batteries are installed in many major passenger EV models in China's domestic market, such as the Tesla Model 3, Model Y, SAIC Mulan, GAC Aion Y and NIO ET5, as well as Chinese commercial vehicle models, and continue to grow steadily, SNE Research said.

BYD installed 29.4 GWh of power batteries from January to April, up 108.3 percent from 14.1 GWh in the same period last year.

The company ranked second with a 16.1 percent share from January to April, up from 11.5 percent in the same period last year but down from 16.2 percent in January-March.

BYD has gained popularity in China's domestic market with its competitive pricing by establishing a vertically integrated supply chain management, including battery self-sufficiency and vehicle manufacturing, SNE Research said.

With the launch of the Atto3 model, BYD showed explosive growth by expanding its market share outside of China in Asia and Europe, SNE Research said.

LG Energy Solution installed 25.7 GWh of power batteries from January to April, up 49.3 percent year-on-year.

The South Korean company ranked third in the world with a 14.1 percent share, unchanged from a year ago.

Japan's Panasonic was fourth with 8.2 percent share, South Korea's SK On was fifth with 5.2 percent share and China's CALB was sixth with 4.6 percent share.

South Korea's Samsung SDI of, China's Gotion High-tech of China, Eve Energy and Sunwoda ranked seventh, eighth, ninth and tenth respectively, with shares of 4.1 percent, 2.4 percent, 1.8 percent and 1.5 percent from January to April, respectively.

It is worth noting that CALB's power battery installed base of 8.4 GWh exceeded Samsung SDI's 7.5 GWh in the January to April period.

In January-March, CALB was 5.7 GWh, lower than Samsung SDI's 6.5 GWh.

In 2023, Chinese companies are expected to enter overseas markets such as the US and Europe in preparation for a gradual decline in growth rates in China's domestic market, the largest EV market, according to SNE Research.

The European EV market, which has relatively fewer political issues than the US, is attracting attention as a strategic point for seeking to diversify the battery supply chain, the report noted.

Going forward, the share of LFP batteries in Europe is expected to increase as Chinese companies enter the European market in earnest, the report said.

CATL unveils Condensed Battery for electric aircrafts and EVs

The post Global EV battery market share in Jan-April: CATL 35.9%, BYD 16.1% appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Tesla And Panasonic Could Get $41 Billion In Tax Credits By 2032

New Tesla Service Bulletin Tries To Address Model Y Water Ingress

China NEV wholesale in May at about 670,000 units, CPCA estimates show

From January to May, China's wholesale sales of passenger NEVs are expected to be 2.78 million units, up 46 percent year-on-year, the CPCA said.

China's wholesale sales of passenger new energy vehicles (NEVs) are expected to be 670,000 units in May, up 11 percent from April and up 59 percent year-on-year, the China Passenger Car Association (CPCA) said in a report today.

In April, the 11 manufacturers with more than 10,000 wholesale sales of NEVs contributed 81.1 percent of all wholesale sales, the CPCA said.

These companies are expected to sell 542,000 units in May, and the normal structure would put China's wholesale sales of passenger NEVs in May at around 650,000 units, the CPCA said.

The CPCA gave a higher estimated figure of 670,000 wholesale sales as the development of China's NEV industry continues to consolidate this year, the report said.

In the January-May period, China's wholesale sales of passenger NEVs are expected to be 2.78 million units, up 46 percent year-on-year, according to the report.

NEVs include battery electric vehicles (BEVs), plug-in hybrids (PHEVs), and fuel cell vehicles.

China's new energy passenger vehicle market returned to stronger growth in May, with sales hitting a new high this year, the CPCA said.

As a result of last year's low base and the recent continued strength of China's passenger NEV exports, vehicle companies in the core regions of the NEV industry chain, including Shanghai, performed well, the CPCA said.

Passenger vehicle sales in China are expected to be 23.5 million units in 2023, including 8.5 million NEVs, and penetration is expected to reach 36 percent, the CPCA said, repeating its previous forecast.

In 2022, wholesale sales of passenger NEVs in China were 6.5 million units, up 96.3 percent year-on-year.

Here are the wholesale NEV sales of major automakers in May, as published by the CPCA.

Tesla sells 77,695 China-made vehicles in May, up 2.44% from Apr

The post China NEV wholesale in May at about 670,000 units, CPCA estimates show appeared first on CnEVPost.

For more articles, please visit CnEVPost.