Xpeng will hold an official launch event for the G6 today starting at 8 pm Beijing time, where the official pricing will be announced.

Xpeng's (NYSE: XPEV) highly anticipated new SUV, the G6, a Tesla (NASDAQ: TSLA) Model Y competitor, will go on sale in China in about 10 hours. Ahead of that, investors are clearly excited.

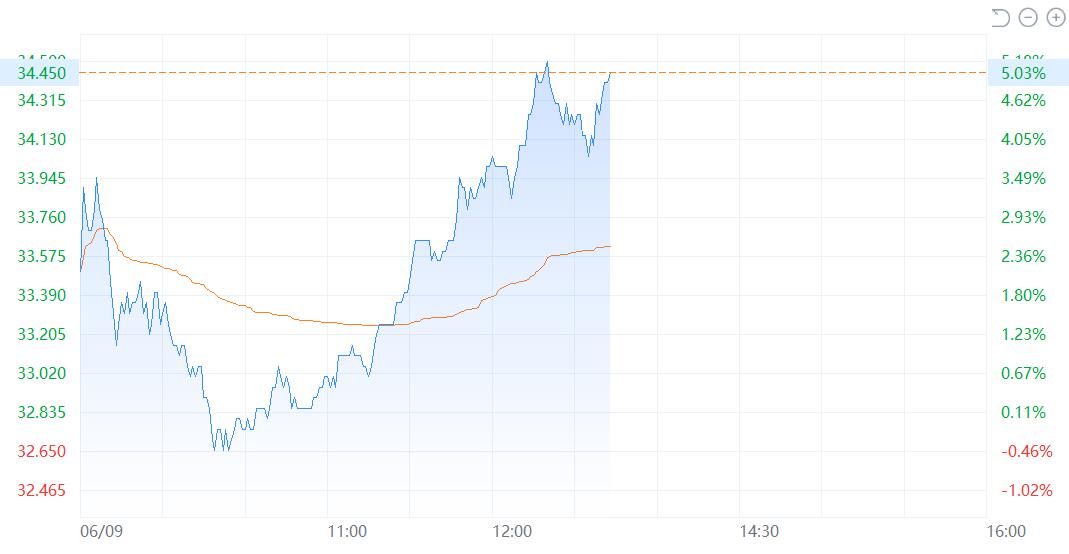

Xpeng's Hong Kong-traded stock was up 4.72 percent to HK$46.90 as of press time, giving it a cumulative gain of more than 18 percent since Monday.

The Chinese electric vehicle (EV) company's US-traded ADRs rose 7.29 percent to $11.78 at yesterday's close, giving it an 18.99 percent gain for the week.

The biggest catalyst driving the rally in Xpeng shares this week is the upcoming launch of the G6.

Xpeng will hold the launch event of the G6 starting at 8 pm Beijing time (8 am US Eastern time) on June 29, and it posted a Weibo early this morning saying that everything is in place for the event.

(Image credit: XPeng)

Xpeng gave the G6 its debut on the first day of the Shanghai auto show on April 18, saying the G6 is the ultimate form of car before full autonomous driving is achieved.

The model is based on the 800 V high-voltage platform and can get a 300-kilometer range in as little as 10 minutes of charge, Xpeng said at the time. The company's other 800 V-based model is the flagship SUV G9.

Xpeng began pre-sales for the G6 on June 9, with pre-sale prices starting at RMB 225,000 ($31,090), significantly lower than the Tesla Model Y's starting price of RMB 263,900 in China.

The Xpeng G6 received more than 25,000 orders within 72 hours of the start of pre-sales, the company announced on Weibo on June 12.

The G6 show cars were already available at Xpeng stores, and the model would officially launch on June 29 with deliveries starting in July, the company said earlier this month.

Referring to the practices of other local Chinese EV companies, Xpeng will likely announce a lower final pricing than the pre-sale price when the G6 officially launches today, thus providing consumers with a surprise that exceeds expectations.

The Xpeng G6 is an all-electric mid-size SUV with a length, width and height of 4,753 mm, 1,920 mm and 1,650 mm, respectively, and a wheelbase of 2,890 mm, a regulatory filing from March showed.

For comparison, the Tesla Model Y has a length, width and height of 4,750 mm, 1,921 mm and 1,624 mm, respectively, and a wheelbase of 2,890 mm.

The G6 will be a hot seller in China's new energy SUV market priced in the RMB 200,000 to 300,000 range and will enable Xpeng's total deliveries to grow well above the industry in the third quarter, the company's management said in a call with analysts after announcing its first-quarter earnings on May 24.

In the view of Wall Street analysts, the G6 will be critical to boosting Xpeng's sluggish sales.

"With margins and cash burn looking materially worse following 1Q earnings, we believe management may be making its last stand with the G6," Deutsche Bank analyst Edison Yu's team said in a research note sent to investors on May 30.

Xpeng management said in a May 24 conference call that it had set aside about two months between the start of production and delivery of the G6, and that Xpeng wanted the model to reach more than twice the sales of the P7i.

This means, according to Yu's team, that Xpeng management expects the G6 to sell 6,000-8,000 units a month.

The G6 needs to be successful for XPeng to be truly relevant to the market again, the team said.

($1 = RMB 7.2379)

XPeng says G6 gets over 25,000 orders 72 hours after pre-sale starts

The post Xpeng shares up nearly 20% this week ahead of G6 launch appeared first on CnEVPost.

For more articles, please visit CnEVPost.

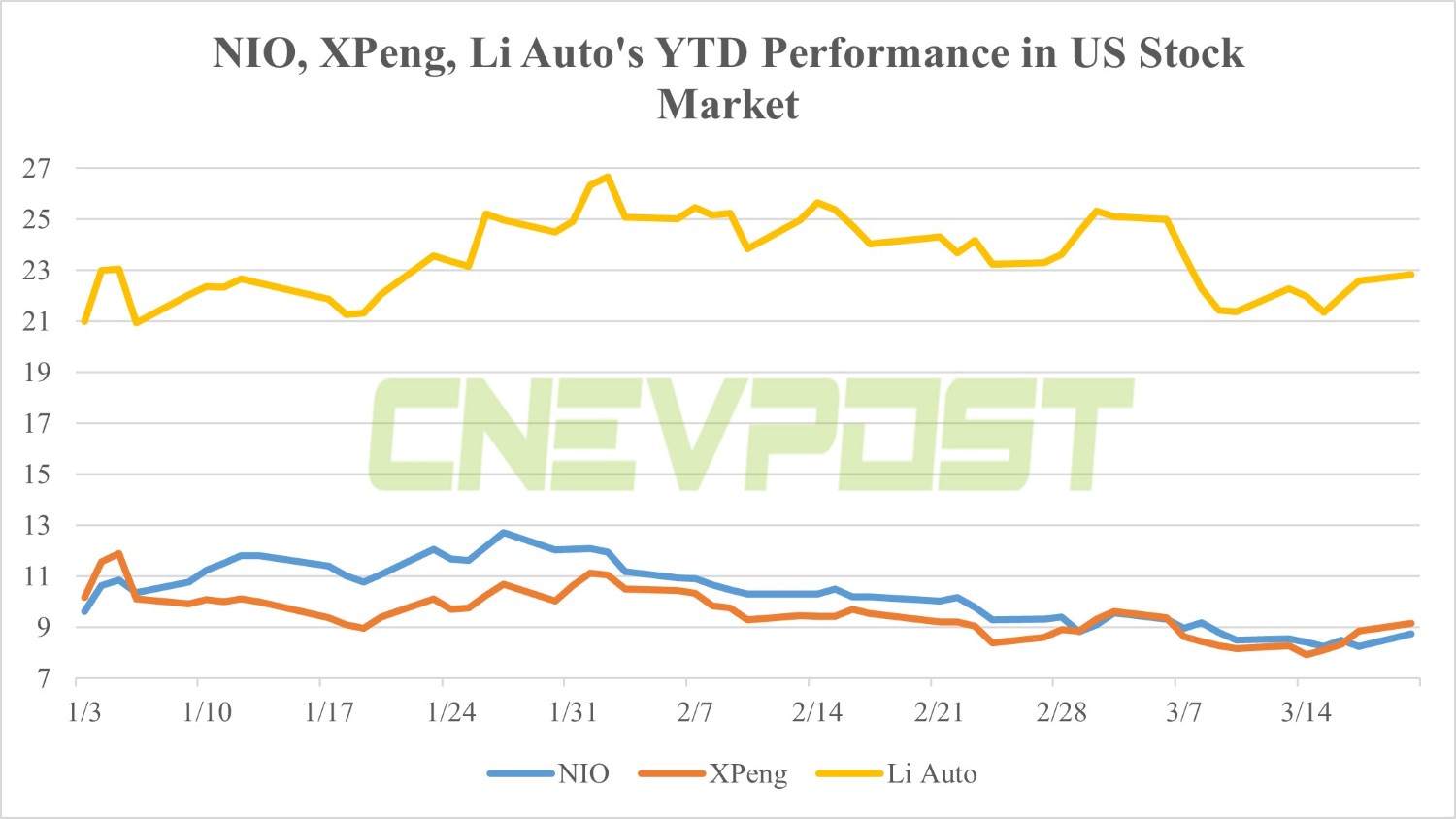

China EV stocks are up an average of 20 percent year-to-date but have underperformed China tech ADRs since December, likely due to investor concerns about weak first-quarter sales and increased competition, according to Edison Yu's team.

China EV stocks are up an average of 20 percent year-to-date but have underperformed China tech ADRs since December, likely due to investor concerns about weak first-quarter sales and increased competition, according to Edison Yu's team. In the meantime, ARKQ has also sold its shares of XPeng three times this month and now holds about $3.77 million worth of the company's stock.

In the meantime, ARKQ has also sold its shares of XPeng three times this month and now holds about $3.77 million worth of the company's stock.