This will help it further expand into the European market and accelerate its globalization, Hesai said.

(Image credit: Hesai)

Hesai Group has opened its first European office in Stuttgart, Germany, which will help it expand further into the European market and accelerate its globalization, the Chinese LiDAR manufacturer announced today.

Stuttgart is the automotive capital of Europe, with more than 2,000 companies in the automotive chain and many top OEMs and large Tier 1 suppliers headquartered here, Hesai said.

More than 20 automotive industry-related universities and R&D institutions provide a large talent base for the automotive industry in the region, it said.

Hesai's European office will leverage local resources in automotive and component manufacturing to enhance the company's presence and overall competitiveness in the European market, Hesai said.

(The building where Hesai's European office is located. Image credit: Hesai)

The company received the TISAX AL3 assessment label, the highest level of information security, this year, passing the European automotive supply chain access requirements and being able to serve European car OEM customers, it said.

Founded in Shanghai in late 2014, Hesai initially focused on developing high-performance laser sensors and has been exploring LiDAR products since 2016.

Hesai opened an office in Palo Alto, Silicon Valley, at its inception and now operates in more than 40 countries and 90 cities worldwide.

The company went public on NASDAQ on February 9, becoming the first Chinese LiDAR manufacturer to go public in the US.

Hesai shipped 47,515 LiDAR units in the fourth quarter, up 739.2 percent from 5,662 units in the same period in 2021, it said in its earnings report on March 16.

The company shipped 80,462 LiDARs for the full year 2022, up 467.5 percent year-on-year.

Hesai's revenue in overseas markets over the past three years reached nearly RMB 1.19 billion ($170 million), accounting for more than half of the company's total revenue.

($1 = RMB 6.9520)

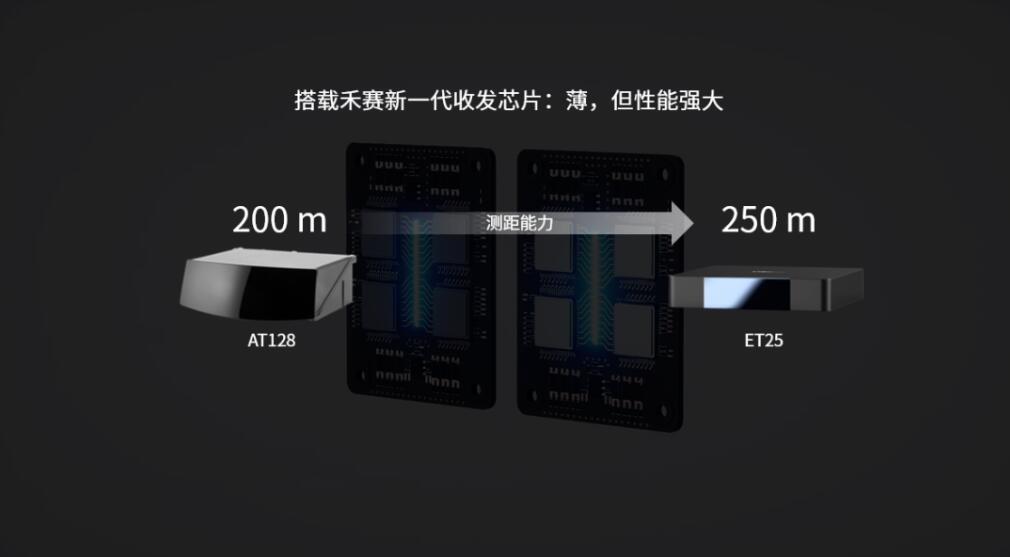

Hesai unveils ultra-thin LiDAR ET25 that can be placed behind windshield

The post Chinese LiDAR maker Hesai opens its 1st European office in Germany appeared first on CnEVPost.

For more articles, please visit CnEVPost.