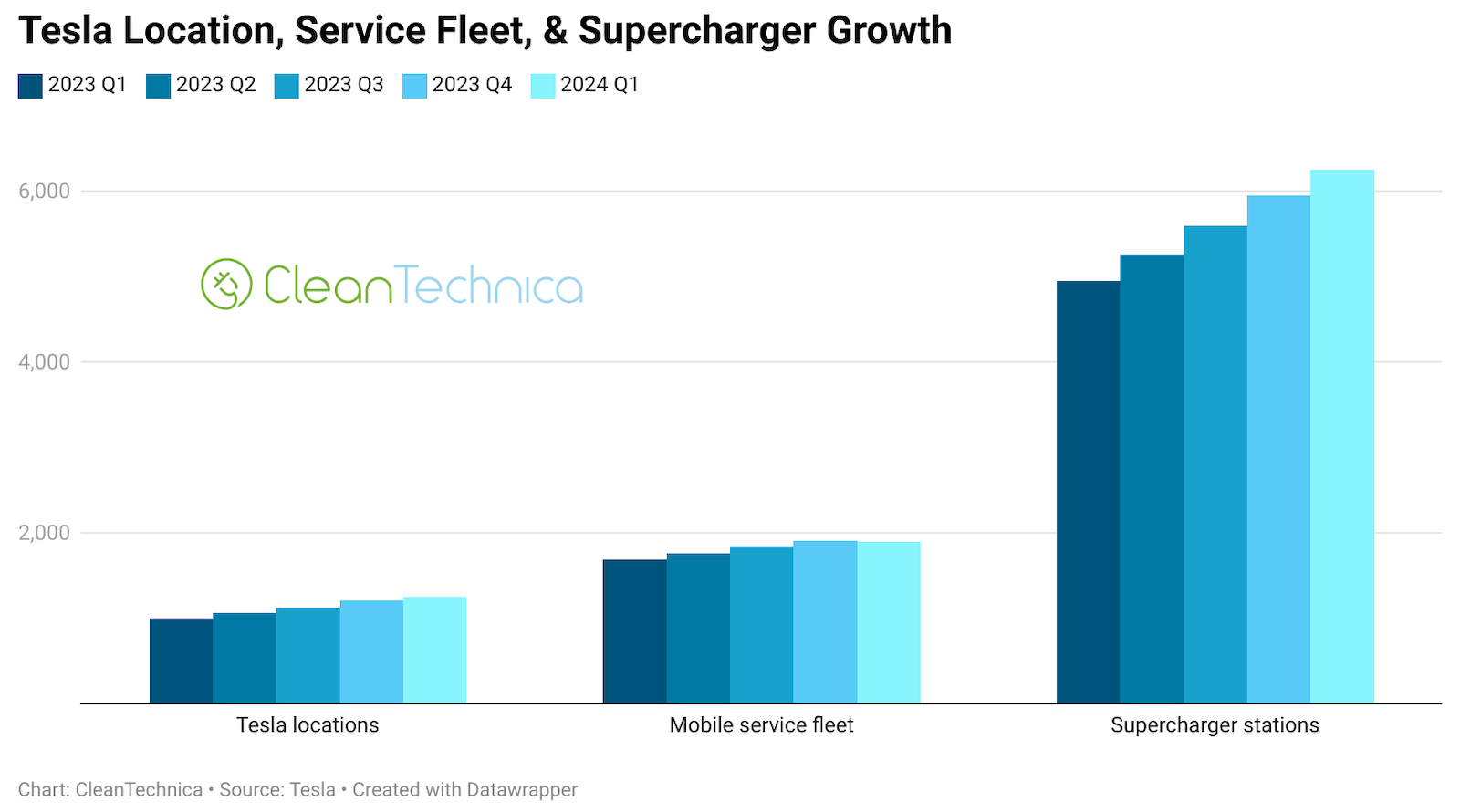

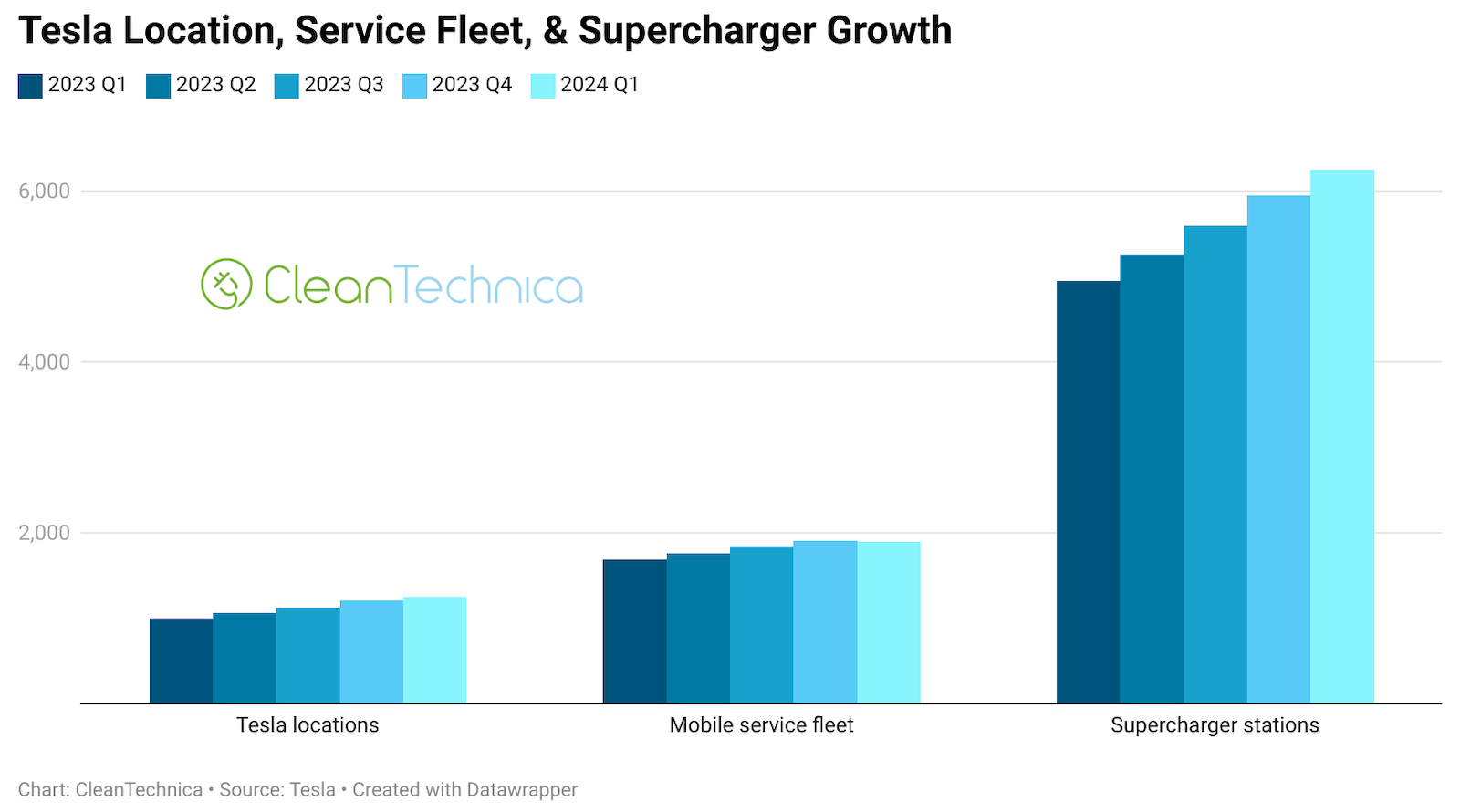

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News! Tesla provides updates on how much its Supercharger network, service fleet, and stores grow each quarter in its shareholder letter. However, it came to my attention a few times in recent months that a ... [continued]