This article is being updated, please refresh later for more content.

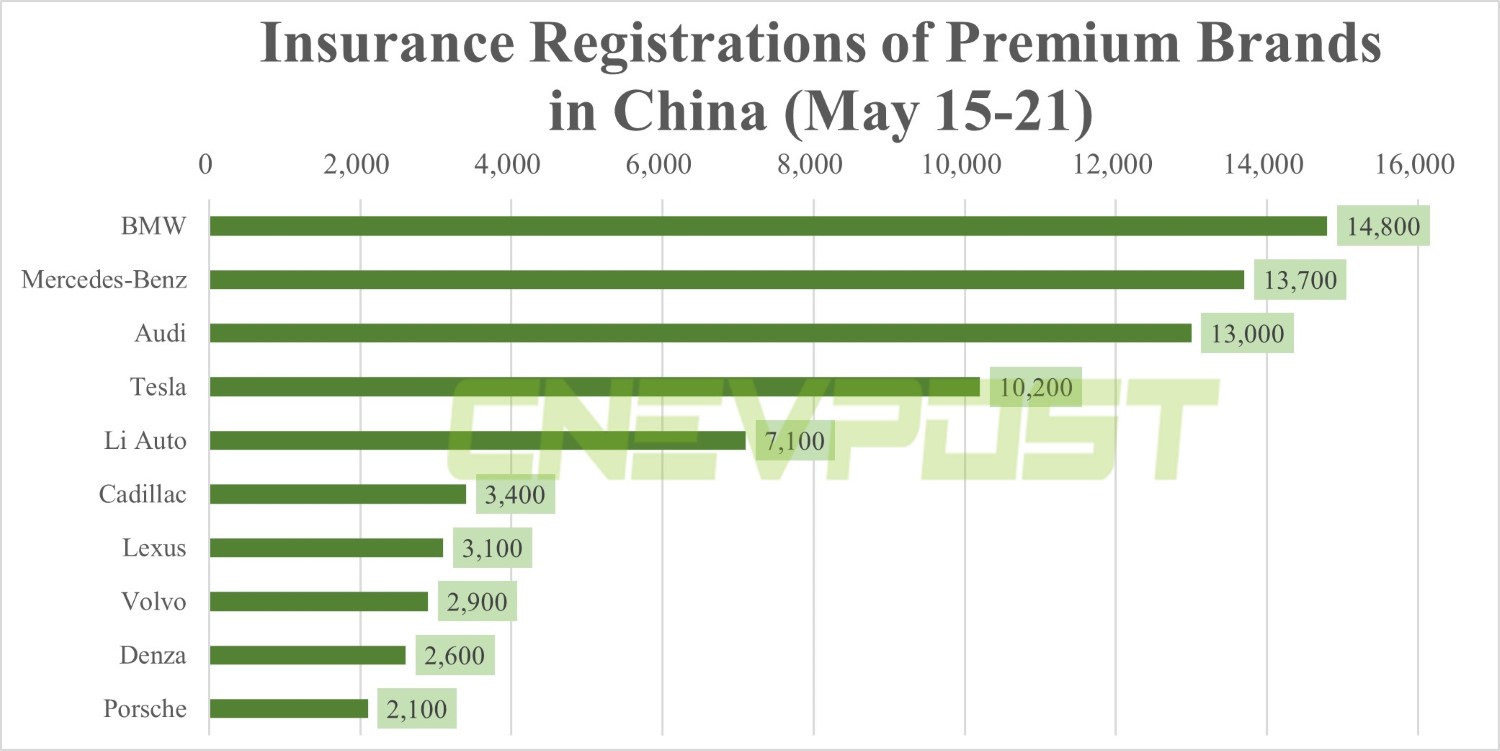

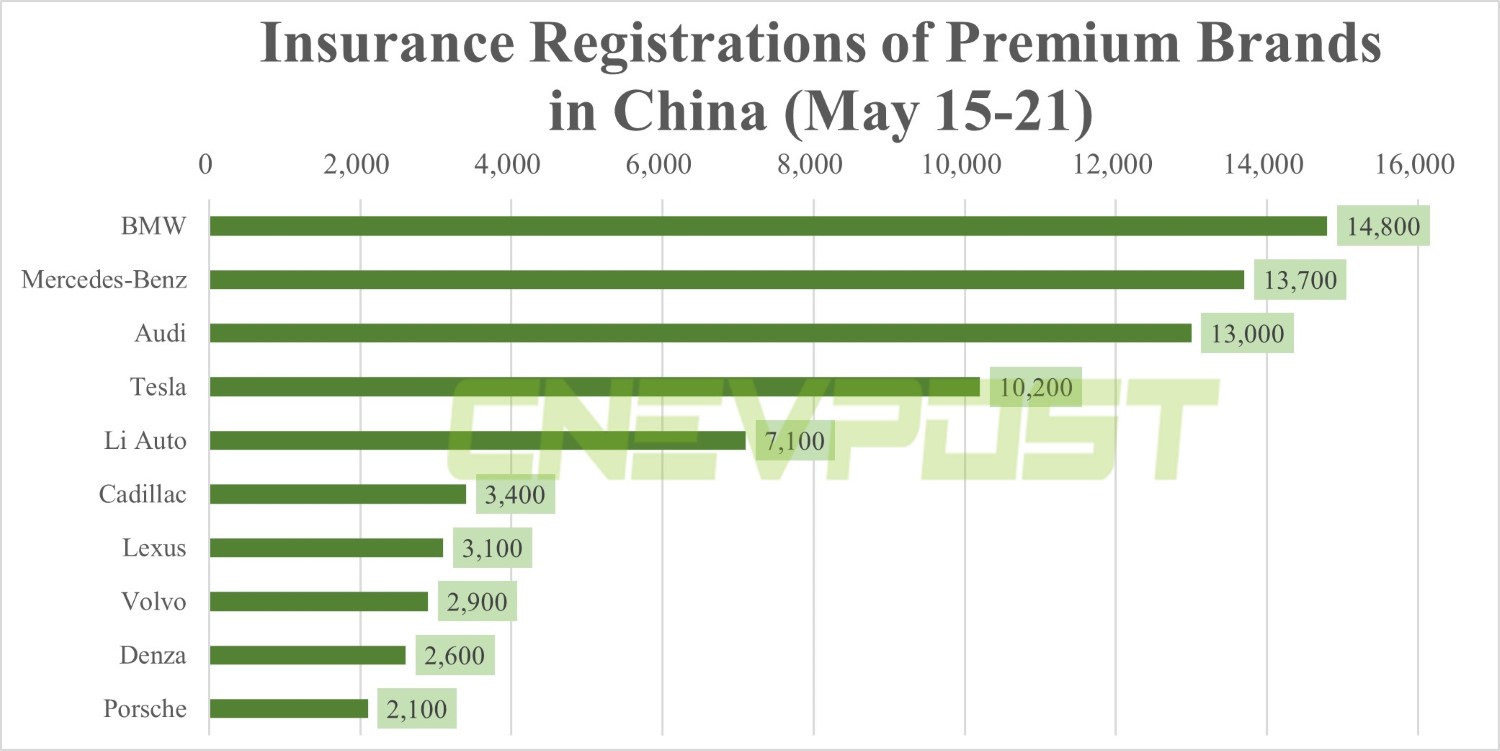

Tesla vehicles registered 10,200 insurance units in China last week, bringing the number to 26,118 for the first three weeks of May.

Li Auto founder, chairman and CEO Li Xiang said last week that they had been complained about by some of their peers and therefore could not continue to share the weekly insurance registration numbers.

Interestingly, however, the company resumed sharing those numbers today to continue to show that it leads the pack among Chinese new energy vehicle (NEV) startups.

For the week of May 15 to May 21, Li Auto sold 7,100 units, far outpacing other new car brands and reigning as the weekly sales leader for new automaking brands in the Chinese market, the company said today on Weibo.

Li Auto did not explain on what basis the sales were counted, but apparently, they were insurance registrations.

Li Auto surpassed all other traditional luxury brands except Mercedes-Benz, BMW and Audi to remain in the top five luxury brands in the Chinese market in terms of sales, the highest-ranked Chinese brand on the list, it said.

In the first two weeks of May, Li Auto vehicles had 4,543 and 6,670 insurance registrations, respectively. This means that from May 1 to May 21, Li Auto sold about 18,313 vehicles.

The tables Li Auto shared today show that NIO vehicles had 1,400 insurance registrations last week. This means that NIO had 3,700 insurance registrations for the first three weeks of May.

NIO deliveries continue to be curbed by the upcoming launch of the new ES6, with insurance registration figures of 1,100 and 1,200 in the first and second weeks of May, respectively.

NIO will officially launch the new ES6 on May 24, and its deliveries will start on May 25.

The company is getting the ES6 to market with unprecedented delivery efficiency, and as of May 20, the new ES6 show cars were available at nearly 300 NIO stores in 92 cities.

XPeng registered 1,500 insurance units last week, the same as the previous week. In the first three weeks of May, XPeng vehicles had 3,870 insurance registrations.

XPeng deliveries were also dampened by the new model G6, which is expected to officially launch and begin deliveries at the end of next month.

Insurance registrations for Tesla vehicles in China were 10,200 last week, bringing the figure to 26,118 for the first three weeks of May. The number was 5,928 and 9,990 in the first two weeks of May.

Data table: China NEV weekly insurance registrations

The post China NEV insurance registrations for week ending May 21: Li Auto 7,100, XPeng 1,500, NIO 1,400 appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Ford CEO Jim Farley on Monday teased the automaker’s upcoming fully electric seven-passenger SUV as being “like your own personal bullet train.” While that might not have been quite as extraordinary a picture as the Millennium Falcon with a back porch he likened Ford’s upcoming Project T3 electric pickup to in March, the...

Ford CEO Jim Farley on Monday teased the automaker’s upcoming fully electric seven-passenger SUV as being “like your own personal bullet train.” While that might not have been quite as extraordinary a picture as the Millennium Falcon with a back porch he likened Ford’s upcoming Project T3 electric pickup to in March, the...  Ford CEO Jim Farley on Monday teased the automaker’s upcoming fully electric seven-passenger SUV as being “like your own personal bullet train.” While that might not have been quite as extraordinary a picture as the Millennium Falcon with a back porch he likened Ford’s upcoming Project T3 electric pickup to in March, the...

Ford CEO Jim Farley on Monday teased the automaker’s upcoming fully electric seven-passenger SUV as being “like your own personal bullet train.” While that might not have been quite as extraordinary a picture as the Millennium Falcon with a back porch he likened Ford’s upcoming Project T3 electric pickup to in March, the...