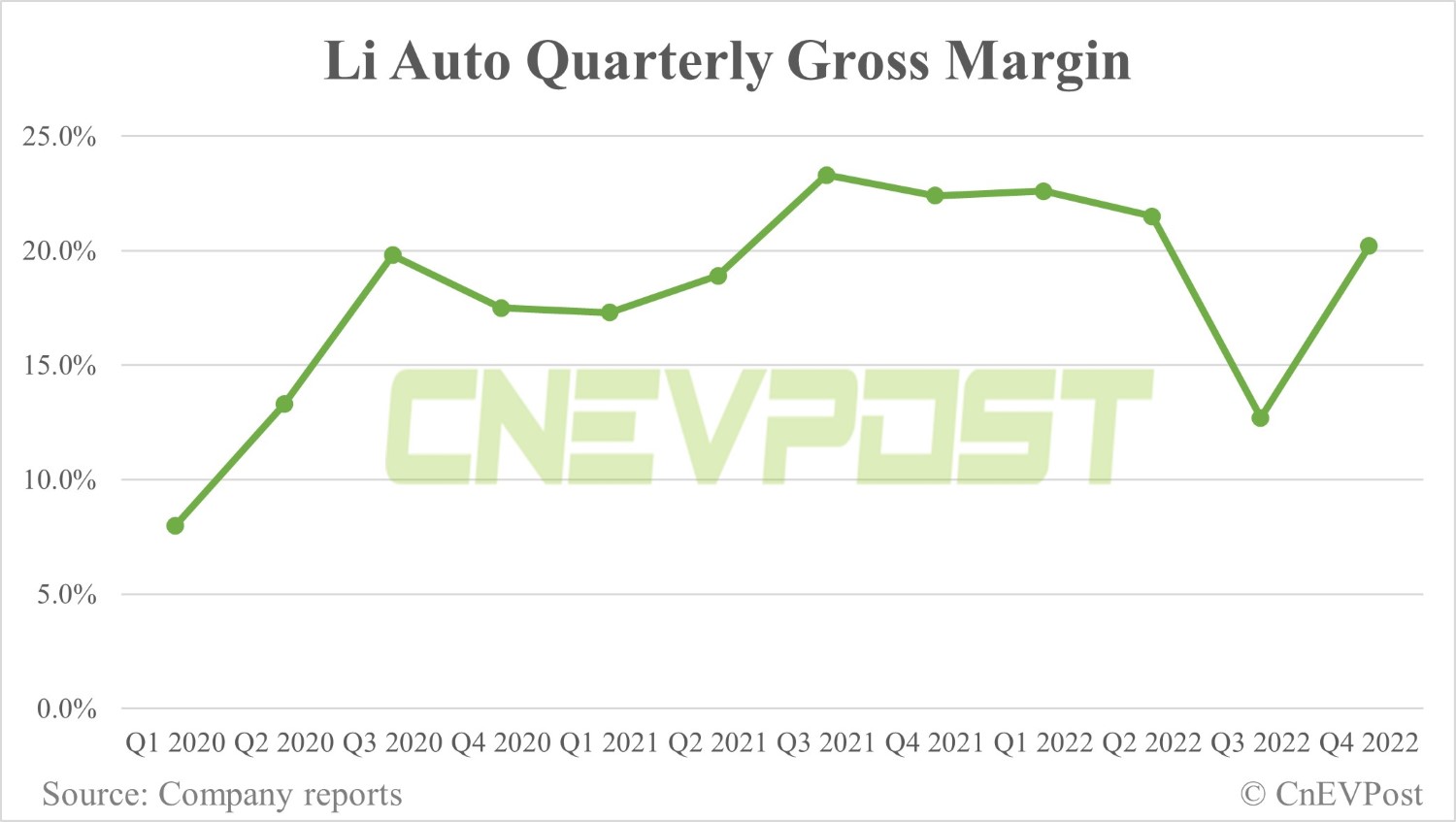

"Even if we exclude these one-time headwinds, vehicle of margin of 13.5% would have been a miss and lowest since 2Q20," Deutsche Bank said.

"Even if we exclude these one-time headwinds, vehicle of margin of 13.5% would have been a miss and lowest since 2Q20," Deutsche Bank said.

The post NIO Q4 earnings: Deutsche Bank's first look appeared first on CnEVPost.

For more articles, please visit CnEVPost.

NIO's vehicle margin was negatively impacted by 6.7 percentage points in the fourth quarter due to accelerated depreciation of production facilities and the loss of purchase commitments for older models.

NIO's vehicle margin was negatively impacted by 6.7 percentage points in the fourth quarter due to accelerated depreciation of production facilities and the loss of purchase commitments for older models. Li Auto has an internal goal of 25,000-30,000 monthly deliveries and will aim to achieve that goal in the second quarter.

Li Auto has an internal goal of 25,000-30,000 monthly deliveries and will aim to achieve that goal in the second quarter. If Li Auto maintains the current level of demand for the second half of the year, there would be upside to consensus estimates, according to Edison Yu's team.

If Li Auto maintains the current level of demand for the second half of the year, there would be upside to consensus estimates, according to Edison Yu's team. Li Auto guided for first-quarter deliveries of 52,000 to 55,000 vehicles, meaning it expects to deliver a total of 36,859 to 39,859 vehicles in February and March.

Li Auto guided for first-quarter deliveries of 52,000 to 55,000 vehicles, meaning it expects to deliver a total of 36,859 to 39,859 vehicles in February and March. Deutsche Bank believes the true test for Li Auto will come in the second half of the year.

Deutsche Bank believes the true test for Li Auto will come in the second half of the year. Deutsche Bank's Edison Yu's team thinks NIO's performance will improve significantly in the second half of the year, but there's a big "IF" in it.

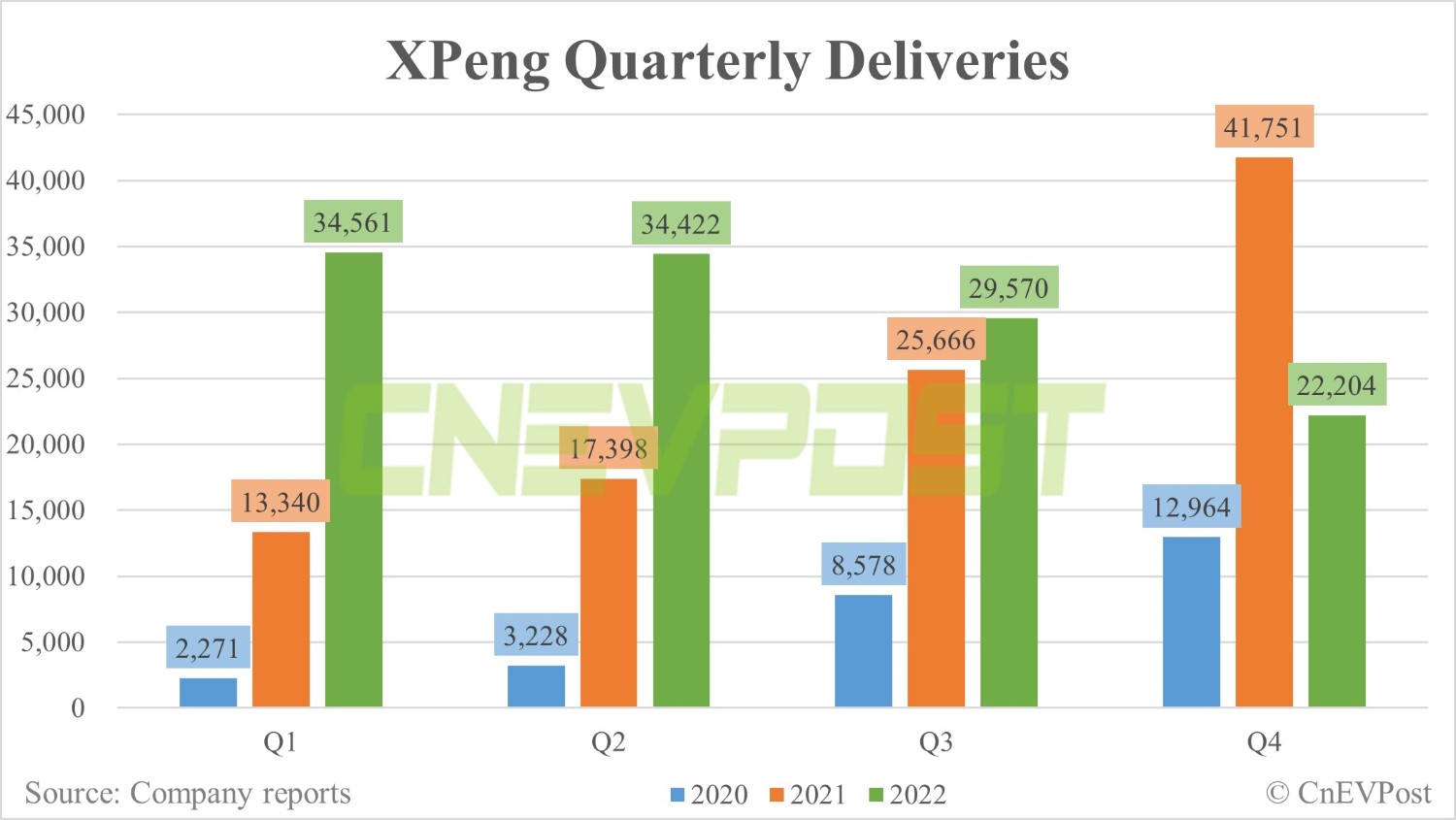

Deutsche Bank's Edison Yu's team thinks NIO's performance will improve significantly in the second half of the year, but there's a big "IF" in it. XPeng delivered 22,204 vehicles in the fourth quarter, above the upper end of the 20,000 to 21,000 guidance range it previously provided.

XPeng delivered 22,204 vehicles in the fourth quarter, above the upper end of the 20,000 to 21,000 guidance range it previously provided. NIO delivered 40,052 vehicles in the fourth quarter, above the upper end of its lowered guidance range of 38,500 to 39,500 vehicles.

NIO delivered 40,052 vehicles in the fourth quarter, above the upper end of its lowered guidance range of 38,500 to 39,500 vehicles. Li Auto has previously released data showing it delivered 46,319 vehicles in the fourth quarter, up 31.51 percent year-on-year and up 74.63 percent from the third quarter.

Li Auto has previously released data showing it delivered 46,319 vehicles in the fourth quarter, up 31.51 percent year-on-year and up 74.63 percent from the third quarter.