Deutsche Bank expects NIO to report soft results for the first quarter, with downside risk to margins, though some relief in on the way.

NIO (NYSE: NIO) will report first-quarter unaudited financial results on Friday, June 9, before the US markets open. As usual, Deutsche Bank analyst Edison Yu's team provided their preview.

"NIO is suffering from weaker-than-expected demand and is facing its greatest adversity since nearly going bankrupt in 2020," the team said in a research note sent to investors today titled "Struggling along for another quarter."

The team expects NIO to report soft results in the first quarter, with downside risk to margins, and a very weak outlook for sales, and margins in the second quarter.

First quarter earnings

Previous data showed that NIO delivered 31,041 vehicles in the first quarter, slightly above the lower end of the guidance range of 31,000 to 33,000 vehicles.

NIO's previous revenue guidance for the first quarter was between RMB 10.93 billion and RMB 11.54 billion, implying year-on-year growth of about 10.2 percent to 16.5 percent.

Yu's team expects NIO to report revenue of RMB 10.9 billion in the first quarter, with a gross margin of 2.5 percent and adjusted earnings per share of RMB -3.07.

This compares to the current analyst consensus estimates of RMB 11.7 billion, 7.4 percent, and RMB -2.66, respectively, in a Bloomberg survey.

Looking ahead, Yu's team expects NIO to deliver 21,000-23,000 units in the second quarter.

NIO delivered only 12,813 units in April and May combined due to very low demand for the ET7 and ES7, the team noted.

The EV maker delivered 6,155 vehicles in May, down 7.55 percent from 6,658 in April, according to data released on June 1.

Why the weak sales?

While production and supply chain issues appear to be resolved, underlying demand for NIO's premium BEVs has been disappointing as customers opt for gasoline models from German luxury carmakers BMW, Mercedes-Benz, Audi and Li Auto EREVs, Yu's team said.

The team attributed NIO's recent weak sales to 3 main factors. The following is from their research note:

1. NIO's pricing is the highest amongst the start-ups and premium BEV demand has been generally weak across the board.

2. The premium segment appears to be electrifying more slowly which may be counter-intuitive to those outside China. Based on our analysis of the premium SUV market (>300k RMB), the BEV mix is only 12% YTD, compared with PHEV (includes EREV) at 18%, leaving 70% for ICE.

This compares with the overall market that is 21% BEV and 10% PHEV, showing customer preferences are quite different depending on the sub-segment.

Our read is the EREV value position is resonating with a much broader audience than anticipated which Li Auto has done a very effective job at maximizing.

3. We believe NIO's brand appeal has hit a wall of sorts as it is struggling to get momentum outside of Shanghai (and surrounding provinces) and also beyond finance/tech social circles.

To illustrate this, we look at the performance of NIO's best-selling ET5. Nearly 40% of sales mix comes from this region and ET5 sells quite poorly in the south despite in theory having the broadest appeal amongst NIO's offerings.

Moreover, based on our channel checks, affluent older customers simply are not buying into the brand (yet) and still prefer traditional BBA cars.

Management will need to figure out ways to augment the appeal of its unique services such as battery swapping. For existing customers, the usage is actually quite high, having set records during recent holiday (69k swaps in one day or ~20% of car parc).

Some relief on the way

NIO officially launched the new ES6 -- the best-selling NIO SUV in history -- in China on May 24, and deliveries began the same night.

In addition to the new ES6, NIO will also begin deliveries of the new ES8 and the ET5 Touring, a derivative of the ET5 sedan, this month.

NIO's deliveries in June will get a boost from a full month of new ES6 deliveries and partial contributions from the ET5 Touring, Yu's team said.

The new ES6 starts at RMB 368,000, higher than expected, as many potential buyers are comparing it to the Li Auto Li L7, which starts at RMB 319,800, the team said.

(Image credit: CnEVPost)

For the ET5 Touring, the team expects pricing to be at RMB 335,000 - RMB 345,000, slightly higher than the regular ET5.

NIO management aims to capitalize on the success of the Zeekr 001, which proves there is a sizable local market for luxury sport EV wagons, the team said.

Yu's team expects NIO to see only a minimal improvement on vehicle margins in the second quarter.

"While lower battery input costs should help by at least 1-2% sequentially along with phasing out of aggressive promotional activity on first-gen 866 models, this will be partially offset by lack of overhead absorption/higher D&A as overall volume in 2Q will be down materially compared with 1Q," the team wrote .

As sales improve in the second half of the year, auto margins should return to double digits, the team said.

On the operating cost side, with sales under so much pressure, Yu's team suspects NIO management may be forced to show some level of restraint.

"We are skeptical NIO can achieve 'core' breakeven in 4Q23 and overall breakeven in 2024," the team wrote.

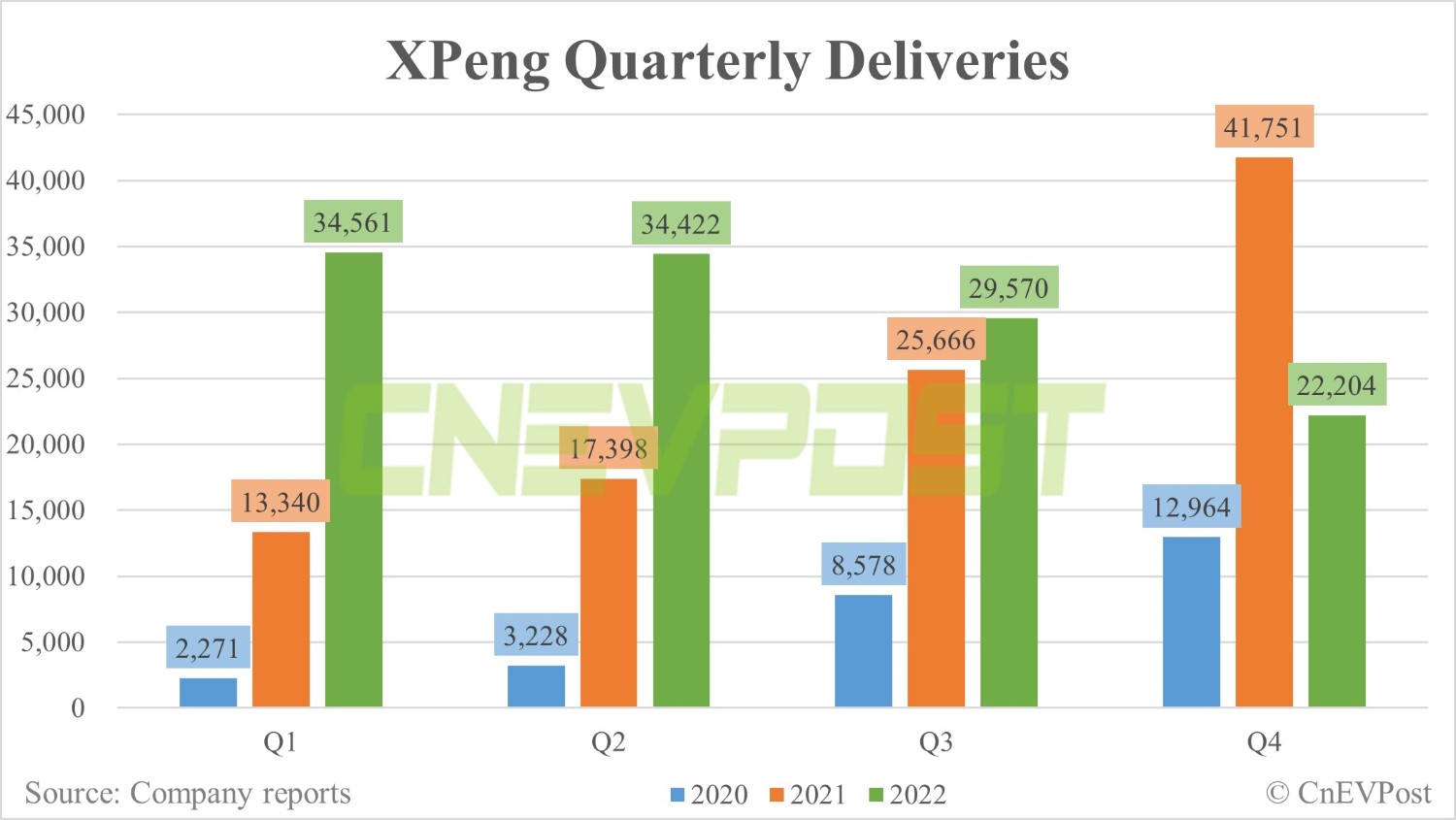

Also, cash burn will intensify due to declining deliveries, similar to what XPeng is experiencing, the team said, adding that they suspect NIO management will roll back its previous RMB 10 billion capex outlook.

Notably, the team remains bullish on the company's prospects, despite many investors have lost patience after multiple sales and margin disappointments.

"We think the stock is already embedding in a very negative path forward and we reiterate NIO's longer-term strategy of having multiple brands, holistic charging infrastructure, and an aspirational ecosystem can still ultimately win out once the dust settles on the EV wars," The team wrote.

NIO's local peers react to launch of new ES6

The post NIO Q1 earnings preview: Struggling along for another quarter appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Deutsche Bank believes the true test for Li Auto will come in the second half of the year.

Deutsche Bank believes the true test for Li Auto will come in the second half of the year. Deutsche Bank's Edison Yu's team thinks NIO's performance will improve significantly in the second half of the year, but there's a big "IF" in it.

Deutsche Bank's Edison Yu's team thinks NIO's performance will improve significantly in the second half of the year, but there's a big "IF" in it.