In October, China's power battery installations amounted to 59.2 GWh, up 51 percent year-on-year and up 8.6 percent from September.

For details, please visit CnEVPost.

In October, China's power battery installations amounted to 59.2 GWh, up 51 percent year-on-year and up 8.6 percent from September.

For details, please visit CnEVPost.

CATL and BYD continued to hold the top two positions as the world's largest battery makers in the January-September period, with the former seeing a slight decrease in share and the latter remaining unchanged.

For details, please visit CnEVPost.

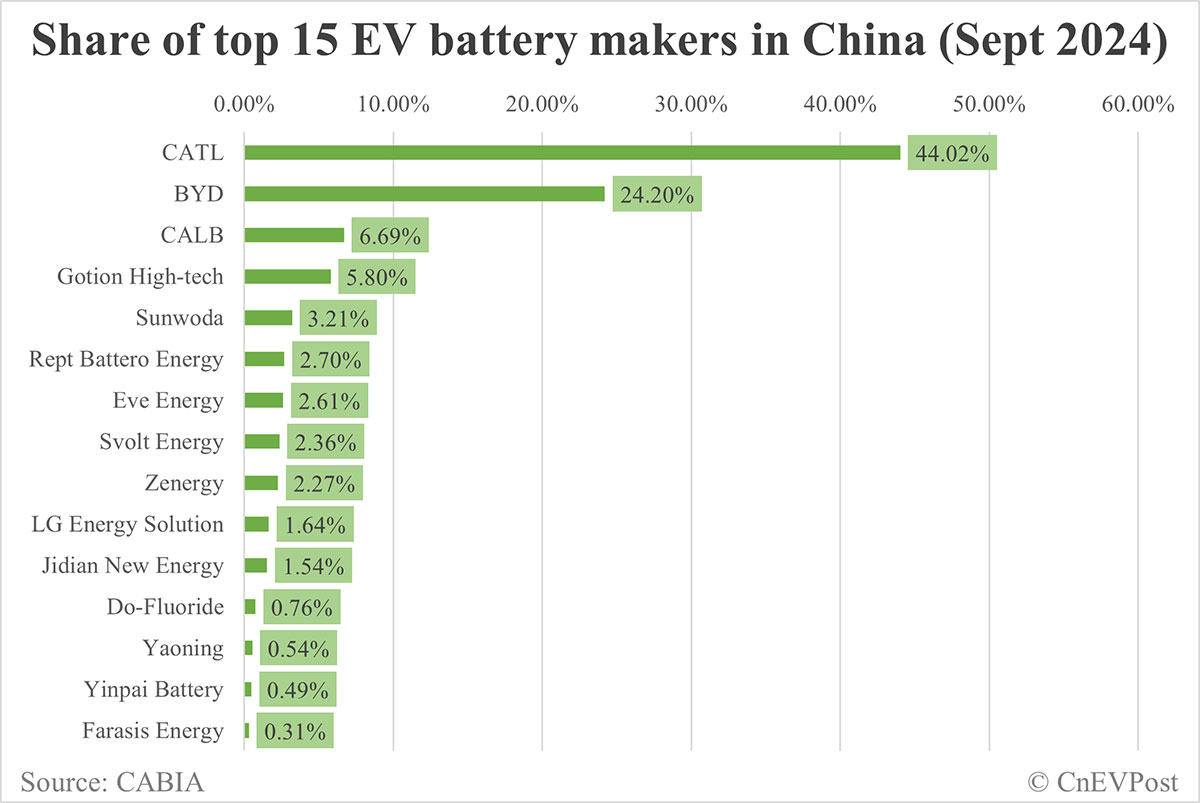

CATL and BYD both saw their share of the Chinese EV battery market decrease slightly in September, as smaller players, including Gotion High-tech, gained share.

For details, please visit CnEVPost.

CATL and BYD continued to hold the top two positions as the world's largest battery makers in the January-August period, with the former seeing a slight decrease in share and the latter an increase.

For details, please visit CnEVPost.

CATL's share in August decreased by 2.84 percentage points from July, while BYD increased by 2.14 percentage points.

For details, please visit CnEVPost.

CATL and BYD continue to hold the top two spots as the world's largest battery makers in January-July, with several other Chinese companies in the top 10.

For details, please visit CnEVPost.

CATL's share increased by 2.24 percentage points in July compared to June, while BYD decreased by 2.49 percentage points.

For details, please visit CnEVPost.

CATL and BYD continued to hold the top two positions as the world's largest battery makers in the first half of 2024, both increasing their share slightly from January-May.

For details, please visit CnEVPost.

CATL's share increased by 1.19 percentage points in June compared to May, while BYD decreased by 3.65 percentage points.

For details, please visit CnEVPost.

CATL continues to be the world's largest battery maker in Jan-May, but share continued to decrease, while BYD continues to increase its share.

For details and more articles, please visit CnEVPost.