Why Arnold Schwarzenegger Wants Us To Focus On “Pollution” Rather Than “Climate Change”

Cumulative sales of Han family models reached 505,062 units and Tang family reached 501,662 units.

(Image credit: BYD)

BYD's (OTCMKTS: BYDDY) two flagship models have both sold more than 500,000 units since their launch, putting combined sales over the 1 million mark.

Cumulative sales of BYD's flagship Han family of sedan models reached 505,062 units and cumulative sales of its flagship Tang family of SUVs reached 501,662 units, bringing total sales of the two models to more than 1 million units, the new energy vehicle (NEV) maker announced today.

The BYD brand's product array includes the Dynasty and Ocean series, with the Han and Tang being models in the Dynasty lineup, which includes both plug-in hybrid and pure electric versions.

The company launched the first-generation Han model in July 2020 and they see cumulative sales of more than 100,000 units in July 2021, according to data monitored by CnEVPost.

On March 16, BYD made the 2023 Han EV available, and on May 18, the hybrid Han DM-i and Han DM-p variants were launched.

BYD sold 240,220 NEVs in May, with Han family models contributing 20,387 units, down 14.82 percent year-on-year but up 42.28 percent from April.

From January to May, the Han family of models sold 71,784 units, up 63.72 percent year-on-year.

The BYD Tang originally debuted at the 2014 Beijing auto show and began production in 2015.

The Tang family of models sold 11,871 units in May, up 40.50 percent year-on-year and up 0.95 percent from April.

From January to May, Tang sold 56,682 units, an increase of 18.85 percent year-on-year.

BYD made the 2023 Tang DM-i available on March 16.

Both BYD Han and Tang family models target the mainstream market in the price range of RMB 200,000 ($28,090) - 300,000.

($1 = RMB 7.1197)

The post BYD sees cumulative sales of Han and Tang family models exceed 1 million appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Second-tier battery makers may adopt a more aggressive pricing strategy to gain market share in the second half of the year, and CATL could face increasing risks to its market share and margins in the domestic market, Morgan Stanley said.

Morgan Stanley downgraded its rating on CATL, citing market share risks, sending shares of the Chinese power battery giant tumbling in morning trading.

"We downgrade CATL to UW as we think second-tier battery makers may adopt more aggressive pricing strategies to gain market share in 2H23," analyst Jack Lu's team said in a research note sent to investors earlier today.

As of press time, CATL shares traded in Shenzhen were down about 6 percent to near their lowest point of the year.

Earlier this year, Morgan Stanley upgraded CATL to equal weight, while being bearish on most battery material makers, as it believes CATL is better able to respond to slowing demand and leverage its cost advantages and bargaining power across the broader value chain.

Now, Lu's team believes that the dual-sourcing battery strategy of local EV companies may help the Tier 2 battery makers achieve their goals, while CATL may face increasing risks in terms of market share and margins in the domestic market.

In February, CATL launched a lithium rebate program to trade cheap lithium resources for market share. However, the subsequent plunge in lithium prices to below RMB 200,000 per ton has led to significant uncertainty about the program, the team said, adding that they have not received any further news about the program.

Meanwhile, battery makers have been offering fairly significant price cuts against the backdrop of falling lithium prices in the second quarter, the team noted.

"Our checks with tier-two battery makers indicate that the price cuts could be in the range of 10-20% during the quarter, with some battery makers likely offering more aggressive cuts than others," the team wrote.

Such actions could threaten CATL's market share in its domestic market, and market share potential is an important stock price driver, the team said.

CATL's power battery installed base in China was 10.26 GWh in April, ranking first with a 40.83 percent share, but down from 44.95 percent in March, China Automotive Battery Innovation Alliance (CABIA) data from last month showed. Data for May is Expected to be available in a few days.

NIO (NYSE: NIO) and Li Auto (NASDAQ: LI) are bringing in new battery suppliers instead of making CATL their sole supplier, Lu's team noted.

"With many new models being launched in the domestic EV market, we think CATL's domestic market share could come under pressure," the team said.

As background, since late last year, regulatory filings for NIO's new NT 2.0-based models have shown battery suppliers that include the smaller CALB in addition to CATL.

Last month, NIO filed to use semi-solid-state batteries from Beijing WeLion New Energy Technology in its models.

On February 8, Li Auto officially launched its first five-seat SUV, the Li L7, and announced the introduction of Sunwoda Electric Vehicle Battery and Svolt Energy as new battery suppliers.

More and more Tier 2 companies are adopting increasingly aggressive pricing strategies, and CATL may have to do the same, according to Lu's team.

Despite a short-term recovery in value chain orders, there will still be excess battery capacity in the short term and price competition is inevitable, the team said.

In addition to the market share pressure it faces domestically, Lu's team believes CATL's overseas path is increasingly uncertain.

"Some investors have argued that CATL's market share overseas is yet to see signs of decline; however, in our view CATL's overseas market is under increasing scrutiny and becoming more and uncertain, limiting visibility," the team wrote.

CATL has tried to penetrate overseas markets through exports and localization of production, but both pathways are increasingly at risk due to geopolitical tensions, particularly in the US, the team said.

Notably, Lu's team stressed that if the cost of battery materials and minerals continues to fall, this could give car companies more room to pursue new technologies and other battery performance metrics.

"If this is the case, CATL could regain any lost market share and continue to dominate the global battery market, leveraging its strong R&D capabilities and bargaining power over the supply chain. Our bull case scenario assumes 60% global market share in the long term," the team wrote.

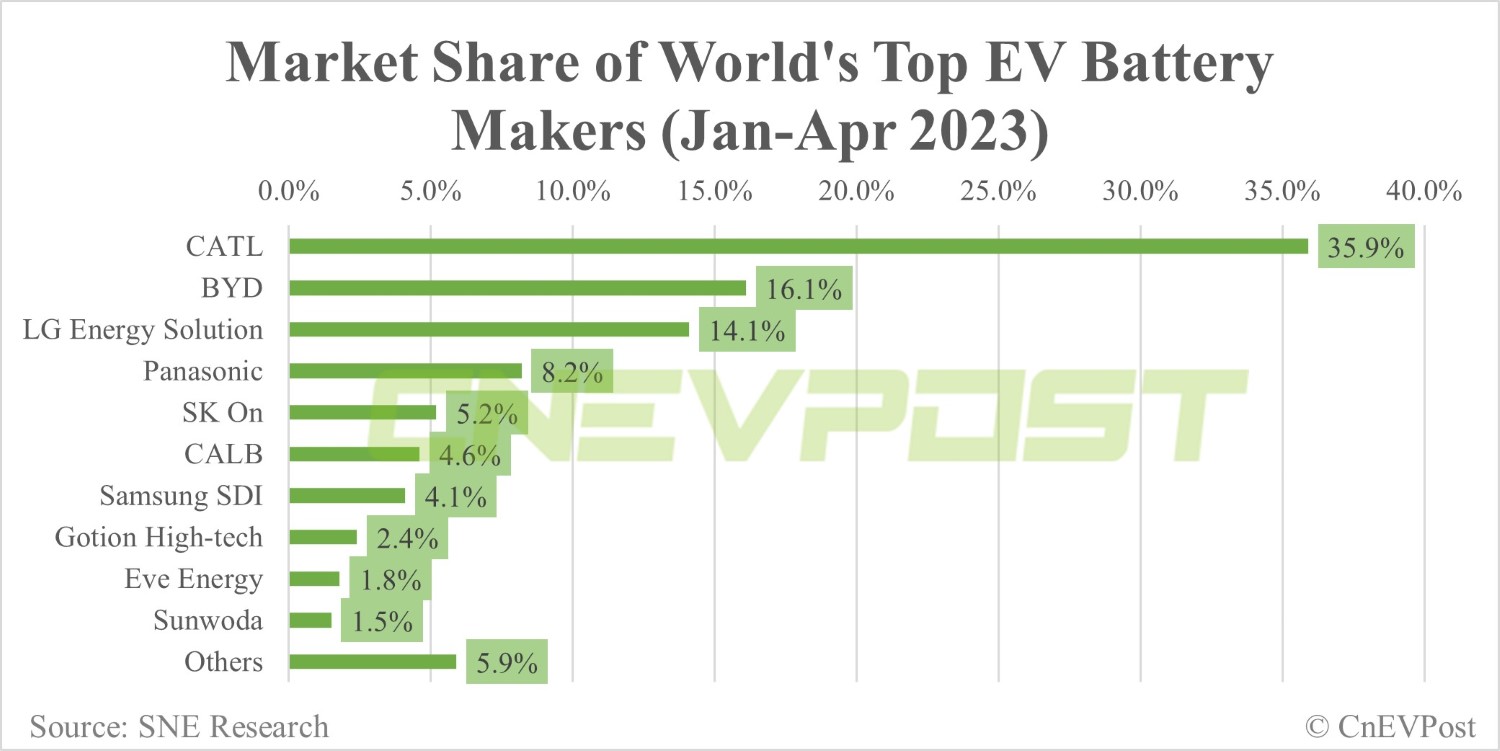

Global EV battery market share in Jan-April: CATL 35.9%, BYD 16.1%

The post CATL shares plunge after Morgan Stanley downgrades rating to underweight appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Neta is actively preparing for entry into the European market and will release a heavyweight global model, it said.

(Image credit: Neta)

Neta Auto, the electric vehicle (EV) brand of Hozon Auto, is sending a new shipment of thousands of EVs to overseas markets for the second time in three months.

A total of 4,000 Neta EVs are being sent abroad, the latest new batch after 3,600 vehicles were sent to overseas markets in March, the company said yesterday in a WeChat post.

Neta did not mention which countries the vehicles will be sent to, although it's possible they will still be in Southeast Asia. A total of 3,600 of the compact SUV Neta V vehicles were sent to Thailand on March 21.

Thailand is Neta's home base for expanding into the ASEAN market, and the Neta V is trusted and loved by local consumers, Neta said yesterday.

From January to April, Neta V ranked second in Thailand with a 16.5 percent share of all-electric vehicle license plate registrations, Neta said, citing data from Thai website AutoLife.

Neta is now actively preparing for its entry into the European market and will participate in the Munich auto show in Germany later this year, and the Neta GT sports car will be launched in overseas markets in the near future, it said.

Neta will also release a heavyweight global model that will accelerate bringing high-quality electric smart cars within reach, it said, without giving further details.

Neta has been seen as a budget EV maker since its inception in October 2014, as its vehicles are priced primarily to target the lower end of the market. The company is trying to create a higher-end image with its flagship sedan, the Neta S, and its sports car, the Neta GT.

As the EV market in China becomes more competitive, local car companies including Neta and NIO (NYSE: NIO) are starting to make more efforts to expand overseas.

Unlike NIO, which is targeting the more developed European market, Neta is focusing its initial efforts on overseas expansion in Southeast Asia.

On August 24, 2022, the right-hand drive version of the Neta V was launched in Thailand as its first model to be offered there.

On March 10, 2023 Neta laid the foundation stone for its factory in Bangkok, Thailand, which will be its main manufacturing base for building right-hand drive electric vehicles for export to ASEAN.

On May 11, Neta announced its entry into Malaysia, officially launching the right-hand drive version of the Neta V for local consumers at the largest auto show in the region.

Neta delivered 13,029 units in May, up 18.35 percent from 13,029 units in the same month last year and up 17.59 percent from 11,080 units in April, according to data released by the company on June 1.

From January to May this year, Neta delivered 50,285 vehicles, up 0.62 percent from 49,974 in the same period last year, data monitored by CnEVPost showed.

The post Neta shipping new batch of 4,000 EVs to overseas markets appeared first on CnEVPost.

For more articles, please visit CnEVPost.

From January to April this year, Neta V ranked second in the number of EV model registrations, surpassing Tesla, in the Thai market, with a market share of 16.5%.

The post Neta exports 4,000 vehicles overseas from China appeared first on CarNewsChina.com.

Filed under: Green,Tesla,Car Buying,Electric

Continue reading Tesla Model 3 now costs as little as $23K in California thanks to tax credits

Tesla Model 3 now costs as little as $23K in California thanks to tax credits originally appeared on Autoblog on Tue, 6 Jun 2023 18:12:00 EDT. Please see our terms for use of feeds.

Permalink | Email this | Comments