How Will The Electric Grid Handle 100% Electric Vehicles? (Part 2)

The BYD Song Plus EV has up to 620 km of range and 218 hp. As for the DM-i version, it can run up to 150 km (CLTC) on a single charge.

The post BYD Song Plus Champion Edition launched in China. EV version starts at 23,700 USD appeared first on CarNewsChina.com.

The Buick Electra E4 starts at RMB 189,900 in China, with deliveries set to begin in July.

(Image credit: Buick)

General Motors' Buick brand has clearly adapted to the competitive Chinese electric vehicle (EV) market, launching its second model built on GM's Ultium platform at a competitive price and fast delivery pace.

Buick officially made the Electra E4, an all-electric coupe SUV, available in China yesterday, just two months after the launch of the Electra E5, its first model built on the Ultium platform.

The Buick Electra E4 is available in four versions in China, starting at RMB 189,900 ($26,520), RMB 209,900, RMB 219,900 and RMB 259,900 respectively.

For comparison, the Tesla Model Y, the best-selling electric SUV in China, starts at RMB 263,900 and the EC7, NIO's coupe SUV, starts at RMB 458,000.

The model will gradually become available in showrooms and its delivery will begin in July, Buick said.

The car is an all-electric coupe SUV with a length, width and height of 4,818 mm, 1,912 mm and 1,581 mm, respectively, and a wheelbase of 2,954 mm.

For comparison, the Electra E5 measures 4,892 mm in length, 1,905 mm in width and 1,655 mm in height, and has a wheelbase of 2,954 mm.

The Buick Electra E4 is available in two power versions, the dual-motor version with a maximum output of 143 kW for the front electric motor and 68 kW for the rear electric motor, accelerating from 0 to 100 km/h in 6.2 seconds.

Its single-motor version features a front motor with a maximum output of 150 kW.

The Buick Electra E4 is powered by a ternary lithium-ion battery supplied by a joint venture between CATL and SAIC, with a 65-kWh pack for the standard range version and a CLTC range of 530 km. Its long-range version has a pack capacity of 79.7 kWh and a CLTC range of 620 km.

Buick is one of the most aggressive in embracing the transition to electrification in the Chinese auto industry. It launched the Electra E5 on April 13, offering five versions with starting prices of RMB 208,900, RMB 222,900, RMB 225,900, RMB 239,900, and RMB 278,900 respectively.

On April 25, Buick announced that the Electra E5 received more than 8,000 orders after 12 days on the market.

On May 29, SAIC Motor, a joint venture between GM and SAIC, said the first deliveries of Electra E5 vehicles had begun, but did not announce the number of deliveries.

($1 = RMB 7.1614)

Buick Electra E5 gets over 8,000 orders in less than 2 weeks after launch in China

The post Buick launches Electra E4 electric SUV in China at competitive pricing appeared first on CnEVPost.

For more articles, please visit CnEVPost.

NIO's first phone model will be released and begin deliveries in the third quarter, William Li said in April.

NIO (NYSE: NIO)'s first mobile phone model completed radio clearance in China, paving the way for its launch later this year.

The electric vehicle (EV) maker's mobile device, model number N2301, received radio approval on June 19, according to a disclosure on the website of China's Ministry of Industry and Information Technology.

The device will support 2G, 3G, 4G and 5G network standards, and will also support UWB (Ultra Wide Band), a key feature when using a phone as a car key.

The disclosure focuses on the radio specifications for the NIO mobile device, covering frequencies, transmit power, and obtaining the approval is a key process to enable it to be sold in China.

In late March 2022, William Li, NIO's founder, chairman and CEO, confirmed that the company would venture into phone making.

A key driver of NIO's decision was that, in the rise of smart cars in China, owners' experiences are increasingly dependent on a direct and seamless connection between their phones and vehicles.

In March last year, Li told a group of car owners that Apple was closed to the automotive industry, for example, NIO's second-generation platform models come standard with UWB, but Apple does not open up the interface.

NIO has to study smartphones and car-centric smart devices from the user's interest and experience, he said at the time.

On April 1, Li said during a Chinese EV industry forum that NIO's first phone model would be launched and start deliveries in the third quarter.

NIO unveiled the new ES8 at its NIO Day 2022 event on December 24, 2022, and an introductory image of the model shows two cell phones in the second-row center armrest.

The wireless charging pad can wirelessly fast charge two phones simultaneously at 40 W, according to the text on the image.

In an internal speech at NIO last November 15, Li said the launch of the phone was a decision based on 5-10 years of long-term strategic thinking, according to local media outlet LatePost at the time.

Internal speech: William Li on NIO's new businesses, and why it's on right side of trend

The post NIO completes key regulatory process for its 1st phone model appeared first on CnEVPost.

For more articles, please visit CnEVPost.

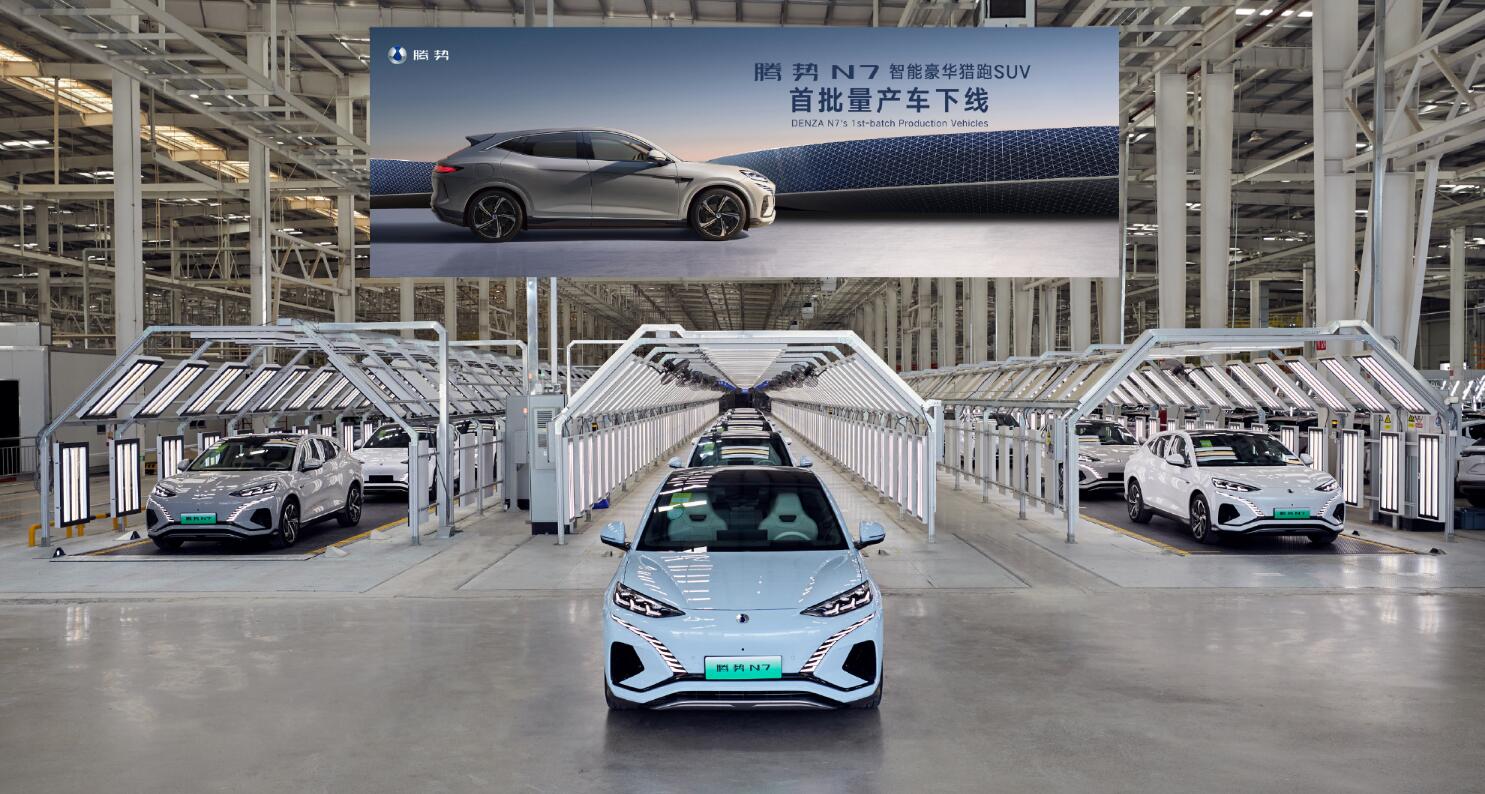

The Denza N7 will go on sale later this month, with deliveries to begin in July. | BYDDY.US | BYD HK

BYD's premium new energy vehicle (NEV) brand Denza has seen the first production vehicles of the N7 SUV roll off the assembly line, Zhao Changjiang, general manager of the brand's sales division, said on Weibo today.

Zhao did not provide any more information, though shared two images of Denza celebrating the moment.

On June 13, Zhao said the Denza N7 had received more than 20,000 pre-orders before specifications and pricing were announced.

On March 26, he said there were many customers who wanted to get the Denza N7 released and on the market as soon as possible, and that the model was expected to receive 30,000 orders before its mid-year launch, according to the volume of inquiries.

Denza is a joint venture formed in February 2011 by BYD and Daimler, with each holding a 50 percent stake at the time. In February 2022, the Daimler brand was rebranded as Mercedes-Benz. BYD's shareholding in Denza increased to 90 percent last year.

In August 2022, Denza let the D9 MPV go on sale, the brand's first model after the reorganization. The Denza N7 is the second model after Denza's sharing-holding change and its first SUV.

On the first day of the Shanghai auto show on April 18, Denza opened reservations for the N7, but its pricing information was not released.

On December 20 last year, Zhao said on Weibo that the Denza N7 aims to capture the market for conventional internal combustion engine cars priced at around 400,000 yuan ($55,750).

On April 25, Denza said the N7 had received 10,569 pre-orders, just seven days after reservations opened.

On May 30, Zhao said at Denza's first brand day event that the Denza N7 would go on sale in late June, with deliveries to begin in July.

The Denza N7 is a 5-seat mid-size SUV with a length, width and height of 4,860 mm, 1,935 mm and 1,602 mm, respectively, and a wheelbase of 2,940 mm, a previous regulatory filing shows.

Denza's only model currently in delivery, the Denza D9, began deliveries at the end of October last year and sold 11,005 units in May this year, the third consecutive month in which it has exceeded 10,000 units.

($1 = RMB 7.1753)

Denza's 1st SUV N7 surpasses 20,000 pre-orders ahead of official launch

The post Denza sees 1st production cars of N7 SUV roll off line appeared first on CnEVPost.

For more articles, please visit CnEVPost.

HiPhi's third model, the HiPhi Y, which will be launched in China on July 15, will also be introduced to the European market soon and will be available for pre-order there by the end of the year.

(Image credit: HiPhi)

Chinese premium electric vehicle (EV) maker Human Horizons' HiPhi brand has announced the European pricing of its models and started accepting pre-orders.

HiPhi began accepting reservations for the HiPhi X and HiPhi Z from local consumers in Germany and Norway, with first deliveries of the vehicles expected to begin in the third quarter, it announced yesterday.

The HiPhi showroom at Munich International Airport in Germany will open shortly, and the first HiPhi X and HiPhi Z have completed their license plate registration in Germany, allowing consumers to visit the showroom to experience the vehicles and book test drives, it said.

The HiPhi X six-seater and four-seater versions start at 109,000 ($119,000) euros and 123,000 euros respectively in Germany. In Norway, they start at NOK 1,164,000 ($108,690), NOK 1,326,000 respectively.

The HiPhi Z starts at 105,000 euros for the five-seat version in Germany and 107,000 euros for the four-seat version. In Norway, they are NOK 1,110,000, NOK 1,143,000 respectively.

(Image credit: HiPhi)

Human Horizons launched the HiPhi X, the first model of the HiPhi brand, in October 2020, and deliveries of the model began in China in May 2021.

The HiPhi X starts at RMB 570,000 ($79,450) in China for the six-seat version and up to RMB 800,000 for the four-seat version.

In August 2022, the HiPhi Z, the second model under the HiPhi brand, went on sale. The model is available in five-seat and four-seat versions, with starting prices of RMB 610,000 and 630,000 yuan in China, respectively, and deliveries began at the end of January.

The HiPhi X is powered by dual motors with a maximum output of 440 kW and accelerates from 0 to 100 km/h in 3.9 seconds.

The car is equipped with a battery pack with a capacity of 97 kWh and a CLTC range of 560 km.

The HiPhi Z is equipped with dual motors with a maximum output of 494 kW and accelerates from 0 to 100 km/h in 3.8 seconds.

The car is equipped with a 120-kWh battery pack and has a CLTC range of up to 705 km.

(Image credit: CnEVPost)

Both models have received EU certification from the TÜV Nord Group for sale in Europe, HiPhi said yesterday.

In Europe, consumers in Germany and Norway will be the first to experience HiPhi's new driving experience, said Mark Stanton, co-founder, CTO and president of Human Horizons Europe.

With Germany and Norway as the starting point, Human Horizons will expand its business to more countries and regions, he said.

The HiPhi Y, the third model of the HiPhi brand, will be launched on July 15 in China, and it will also be introduced to the European market soon and will be available for pre-order by European consumers by the end of the year, the company said.

The HiPhi Y was included in the latest list of models that will be allowed to be sold in China, announced by the Chinese Ministry of Industry and Information Technology (MIIT) on February 13.

The HiPhi Y will have a single-motor and a dual-motor version, with the single-motor version having a maximum motor power of 247 kW. Its dual-motor version has an additional front motor with a maximum power of 124 kW, according to the filing.

HiPhi was finalizing the pricing for the HiPhi Y series, with the 560 km range version expected to be set at RMB 369,000 to start, said Xu Bin, HiPhi's brand and communications manager, on May 24.

($1 = EUR 0.9160, $1 = NOK 10.7093, $1 = RMB 7.1745)

Saudi Arabia signs $5.6 billion deal with Chinese EV maker Human Horizons

The post HiPhi begins accepting pre-orders for HiPhi X and HiPhi Z in Europe, deliveries to begin in Q3 appeared first on CnEVPost.

For more articles, please visit CnEVPost.

NIO's about-face highlights the plight now facing China's EV makers, as they try to navigate an unexpected turn in the road that analysts say could stretch on for some time to come.

This article by Trevor Mo was first published in The Bamboo Works, which provides news on Chinese companies listed in Hong Kong and the United States, with a strong focus on mid-cap and also pre-IPO companies.

(Image credit: CnEVPost)

Key Takeaways:

NIO cut its prices last week, reversing its previous position, in response to slowing sales growth over the past two months after many of its rivals made similar reductions.

Smaller firms could be the most vulnerable if the current EV price war drags on, due to their thinner margins compared to larger peers.

Used to being praised for its cutting-edge electric vehicles (EVs), NIO Inc. (NIO.US; 9866.HK) found itself in unfamiliar terrain last week when it became the target of online sarcasm after announcing it would slash prices for all of its electric vehicles (EVs) by 30,000 yuan ($4,209).

Just two months earlier, CEO William Li had proclaimed he would never join the price war now throttling his sector, saying such blind cuts would only lead to "unhealthy competition".

NIO's about-face highlights the plight now facing China's EV makers, as they try to navigate an unexpected turn in the road that analysts say could stretch on for some time to come. Smaller firms are in the most difficult bind since further cuts will further erode their already thin margins. But refusing to stay in the cutting game risks losing sales to industry heavyweights such as BYD (1211.HK; 002594.SZ) and Tesla (TSLA.US).

We'll look shortly at how the recent price war is affecting China's smaller homegrown EV makers, which also include Li Auto (LI.US; 2015.HK), Leapmotor (9863.HK) and XPeng (XPEV.US; 9868.HK), as well as non-listed peers like WM Motor. But first, we'll shift into reverse to see how the ongoing months-long price war has evolved.

Things began last October when Tesla cut prices for its Model 3 and Model Y by as much as 9 percent, then further slashed prices as much as another 13.5 percent in January.

Those cuts prompted others to follow suit, with XPeng announcing reductions in January for its G3i SUV and P5 and P7 sedans by as much as 13 percent. BYD joined the following month by cutting the price of its 2021 Han EV model by 20,000 yuan in Beijing, and the 2021 Qin EV by 15,000 yuan.

Other brands, from domestic heavyweights like GAIC, SAIC, and FAW, to foreign names like Ford, Volkswagen, BMW, and Toyota, also joined the bloodbath. The cuts followed Beijing's retirement of one of the main government incentive programs for EV purchases at the end of last year, which previously helped to double the sector's sales in 2022.

The price war later spilled into the fossil fuel vehicle sector as well, with automakers rushing to clear inventory before a new set of stringent emissions standards takes effect in July.

As of late March, more than 40 carmakers had gotten sucked into the Chinese price war by offering discounts on electric and gas-powered vehicles, according to local media outlet Yicai, which cited data from third-party consultancy Positioning Pioneers.

As the cutting gained traction, about 20 percent of passenger cars being sold in China came with discounts of 10,000 yuan or more, according to PingWest, another local news outlet, citing data compiled by research group China Auto Market.

Driving consolidation

The price war is already showing signs of driving consolidation in a crowded sector whose growth was fueled in no small part by strong government incentives that are now being rapidly phased out.

As the war drags on, bigger players are increasingly cementing their leading positions, while smaller ones face sluggish sales. In the first four months of this year, three companies – BYD, Tesla and GAC Aion – held a combined 50.1 percent share of the pure-battery EV market, up from 42.7 percent in the same period a year ago, according to the China Passenger Car Association (CPCA). BYD led the trio with 24.9 percent of the market, up 7.4 percentage points year-on-year.

As the big names gained share, many smaller brands moved in the opposite direction. XPeng reflected that group, symbolically dropping off the list of the top 10 EV makers in the first four months of this year.

NIO managed to increase its share by 0.3 percentage points, but its 27.1 percent growth rate in vehicle deliveries during the period was far behind BYD and Tesla, which each recorded more than 60 percent year-on-year growth.

Facing such slowing growth, it comes as little surprise that NIO has finally joined the price war. But it also remains to be seen whether the move will significantly boost its sales.

XPeng's experience suggests otherwise. Its massive price cuts in January failed to lift sales, and the company's total vehicle deliveries actually plunged by 47.3 percent in the first three months of this year.

Another smaller EV startup, Leapmotor, announced similarly dismal results after rolling out its own massive price cuts. The company's vehicle deliveries tumbled by 51.3 percent in the first quarter to 10,509, according to its latest quarterly report.

Not all smaller players have suffered. Li Auto – the last holdout in the intensifying price war – delivered 52,584 vehicles during the first quarter, up 65.8 percent year-on-year. The company also recorded a 933.8 million yuan net profit for the period, making it one of the few EV makers that has been able to operate profitably. Both BYD and Tesla recorded profits during the period, while NIO, XPeng, and Leapmotor all lost money.

The smaller companies' dismal bottom-line performance is reflected in their profit margins that sharply trail their larger peers. NIO, XPeng, and Leapmotor all recorded gross profit margins of less than 2 percent during the first quarter, well behind BYD's 17.9 percent and Tesla's even higher 19.3 percent for its EV business.

That brings us back to the dilemma now confronting smaller firms that will find it increasingly difficult to wage a prolonged price war that sucks up their dwindling cash hordes, with skeptical investors unlikely to provide fresh funds.

NIO's cash fell to 37.8 billion yuan by the end of March from 45.5 billion three months earlier, while XPeng's fell to 34 billion yuan from 38 billion yuan over the same period. Those declines are likely to continue, or even accelerate if the price war continues.

The war has already left a number of the smallest major EV makers teetering on the brink of insolvency. One of those is WM Motor, a former highflyer that is currently facing a financial crunch that saw it reportedly slash salaries and implement mass layoffs late last year and into 2023. Data from the CPCA showed that WM Motor sold just 457 vehicles in the first two months of 2023, down 92.4 percent from the year-ago period.

BREAKING: NIO cuts starting prices by $4,200 for all models and makes battery swap benefits optional

The post China's EV sector at crossroads as NIO joins bloody price war appeared first on CnEVPost.

For more articles, please visit CnEVPost.