Second-tier battery makers may adopt a more aggressive pricing strategy to gain market share in the second half of the year, and CATL could face increasing risks to its market share and margins in the domestic market, Morgan Stanley said.

Morgan Stanley downgraded its rating on CATL, citing market share risks, sending shares of the Chinese power battery giant tumbling in morning trading.

"We downgrade CATL to UW as we think second-tier battery makers may adopt more aggressive pricing strategies to gain market share in 2H23," analyst Jack Lu's team said in a research note sent to investors earlier today.

As of press time, CATL shares traded in Shenzhen were down about 6 percent to near their lowest point of the year.

Earlier this year, Morgan Stanley upgraded CATL to equal weight, while being bearish on most battery material makers, as it believes CATL is better able to respond to slowing demand and leverage its cost advantages and bargaining power across the broader value chain.

Now, Lu's team believes that the dual-sourcing battery strategy of local EV companies may help the Tier 2 battery makers achieve their goals, while CATL may face increasing risks in terms of market share and margins in the domestic market.

In February, CATL launched a lithium rebate program to trade cheap lithium resources for market share. However, the subsequent plunge in lithium prices to below RMB 200,000 per ton has led to significant uncertainty about the program, the team said, adding that they have not received any further news about the program.

Meanwhile, battery makers have been offering fairly significant price cuts against the backdrop of falling lithium prices in the second quarter, the team noted.

"Our checks with tier-two battery makers indicate that the price cuts could be in the range of 10-20% during the quarter, with some battery makers likely offering more aggressive cuts than others," the team wrote.

Such actions could threaten CATL's market share in its domestic market, and market share potential is an important stock price driver, the team said.

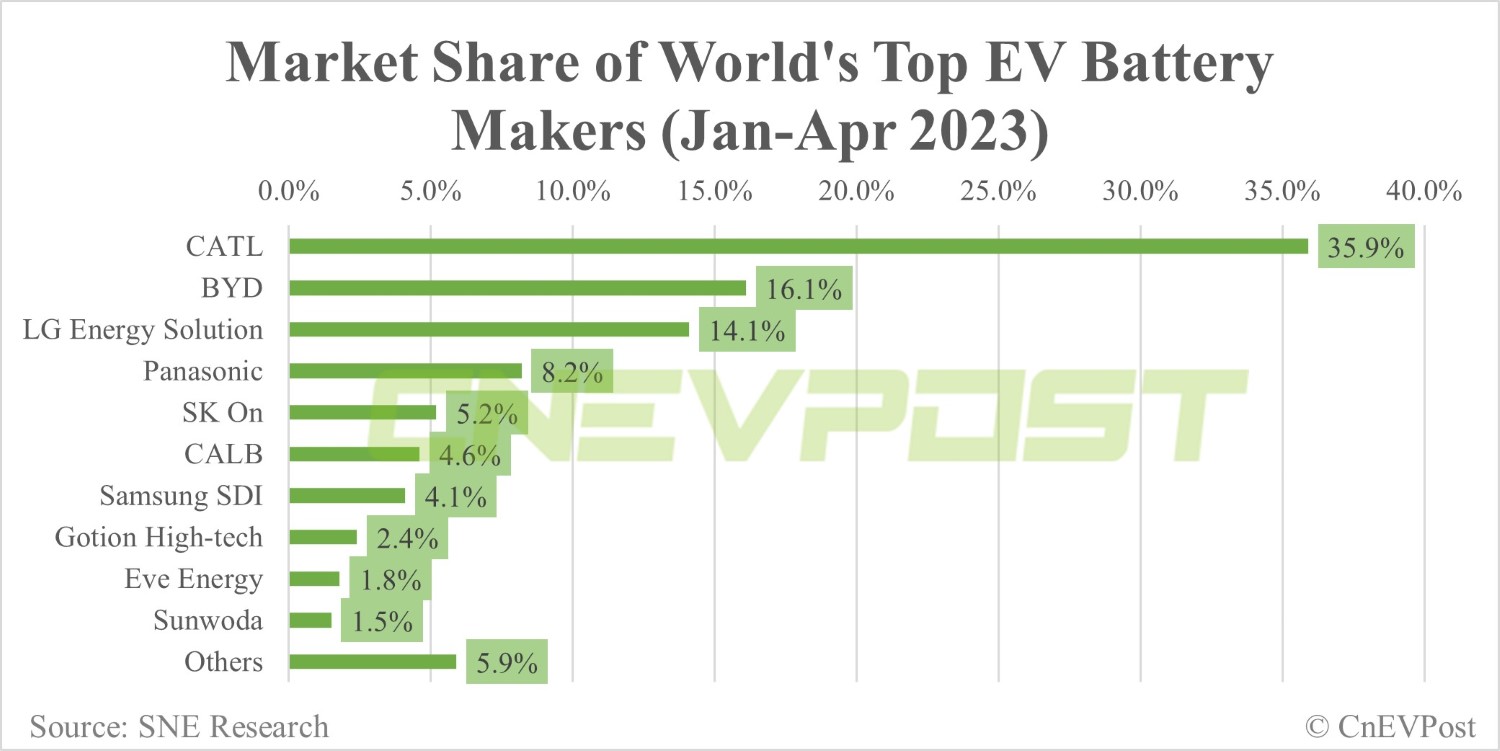

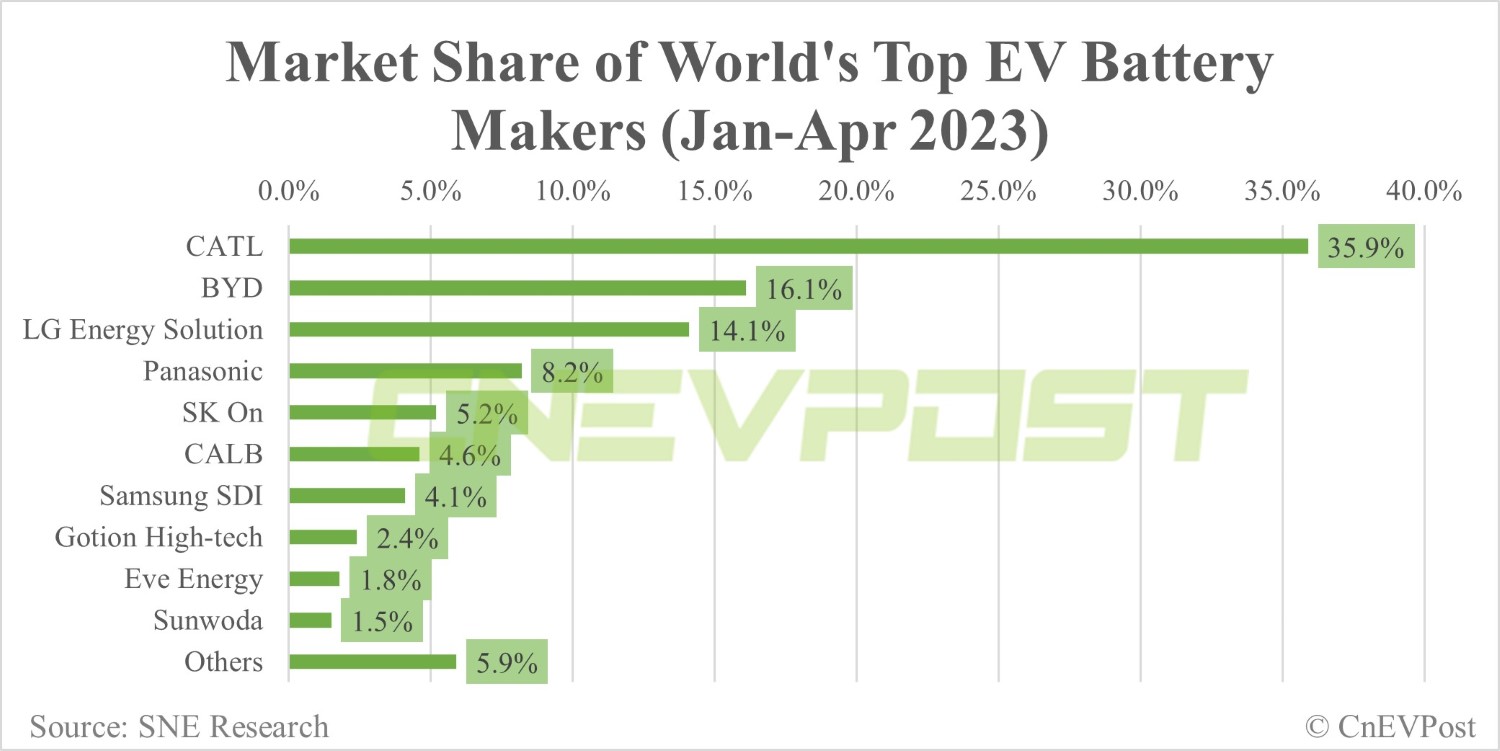

CATL's power battery installed base in China was 10.26 GWh in April, ranking first with a 40.83 percent share, but down from 44.95 percent in March, China Automotive Battery Innovation Alliance (CABIA) data from last month showed. Data for May is Expected to be available in a few days.

NIO (NYSE: NIO) and Li Auto (NASDAQ: LI) are bringing in new battery suppliers instead of making CATL their sole supplier, Lu's team noted.

"With many new models being launched in the domestic EV market, we think CATL's domestic market share could come under pressure," the team said.

As background, since late last year, regulatory filings for NIO's new NT 2.0-based models have shown battery suppliers that include the smaller CALB in addition to CATL.

Last month, NIO filed to use semi-solid-state batteries from Beijing WeLion New Energy Technology in its models.

On February 8, Li Auto officially launched its first five-seat SUV, the Li L7, and announced the introduction of Sunwoda Electric Vehicle Battery and Svolt Energy as new battery suppliers.

More and more Tier 2 companies are adopting increasingly aggressive pricing strategies, and CATL may have to do the same, according to Lu's team.

Despite a short-term recovery in value chain orders, there will still be excess battery capacity in the short term and price competition is inevitable, the team said.

In addition to the market share pressure it faces domestically, Lu's team believes CATL's overseas path is increasingly uncertain.

"Some investors have argued that CATL's market share overseas is yet to see signs of decline; however, in our view CATL's overseas market is under increasing scrutiny and becoming more and uncertain, limiting visibility," the team wrote.

CATL has tried to penetrate overseas markets through exports and localization of production, but both pathways are increasingly at risk due to geopolitical tensions, particularly in the US, the team said.

Notably, Lu's team stressed that if the cost of battery materials and minerals continues to fall, this could give car companies more room to pursue new technologies and other battery performance metrics.

"If this is the case, CATL could regain any lost market share and continue to dominate the global battery market, leveraging its strong R&D capabilities and bargaining power over the supply chain. Our bull case scenario assumes 60% global market share in the long term," the team wrote.

Global EV battery market share in Jan-April: CATL 35.9%, BYD 16.1%

The post CATL shares plunge after Morgan Stanley downgrades rating to underweight appeared first on CnEVPost.

For more articles, please visit CnEVPost.