EV Owners Are Less Satisfied With The Service Experience Than Owners Of ICE Cars: Study

Mullen has acquired Qiantu's North and South American intellectual property and distribution rights, allowing the assembly and distribution of the Qiantu K50 in the Americas. | Mullen Automotive Inc

(Image credit: Qiantu)

Qiantu inks deal with Mullen to tap US market, K50 supercar to be rebranded as Mullen GT and GTRS

Mullen has been granted Qiantu's North and South American intellectual property and distribution rights, allowing the assembly and distribution of the Qiantu K50 in the Americas.

Qiantu Motors, which is almost forgotten in its home market of China, is partnering with an American electric vehicle (EV) maker to bring its electric supercar back to life.

Qiantu recently signed a strategic partnership agreement with Mullen Automotive to expand into the Americas, according to a press release from the Chinese startup today.

Qiantu will leverage its strengths in vehicle design, technology development, and process innovation, combined with Mullen's manufacturing and sales strengths in the Americas market, to bring new EV options to consumers in the Americas, the release said.

Qiantu's partnership with Mullen dates back to 2019, when the two partnered on the marketing of the Qiantu K50 in North America.

With the signing of the latest partnership agreement, the Qiantu K50 will transition from the marketing phase to a substantial production and sales phase, the release said.

The partnership area will also be expanded from the North American market to include the entire Americas, according to the release.

Separately, Mullen said in its March 20 press release that it has been granted the North and South American intellectual property and distribution rights for Qiantu and its affiliates, allowing assembly and distribution of the Qiantu K50 in the Americas.

Mullen will begin its program to re-engineer and re-design the product to meet requirements for US certification and customer expectations for today's supercars, with final assembly in Mishawka, Indiana, the US EV maker said.

These modifications will be consistent with Mullen's current vehicle design language in the Mullen FIVE and Mullen FIVE RS.

To ensure supercar status, the car will also feature an updated powertrain, targeting a 0-60 mph time of less than 2.0 seconds and a top speed of more than 200 mph.

(Image credit: Mullen)

Qiantu, a wholly owned subsidiary of CH-Auto Technology Co Ltd, was founded in 2015 and was one of the first EV startups in China.

Qiantu's first model, the Qiantu K50, was launched in 2018 at a then subsidized price of RMB 686,800 ($99,860), but the model did not earn recognition for the company and was discontinued in November 2020.

On December 18, 2021, Qiantu held a strategy sharing session at its plant in Suzhou, marking its return after a two-year hiatus.

On June 6, 2022, Qiantu announced the start of pre-sales in China for its second model, the Qiantu K20, a two-door, two-seat hatchback with a pre-sale price range of RMB 86,800 to 149,800.

On October 24, 2022, Qiantu and Appollen EV held a launch event in Malaysia to showcase and start pre-sales of the Qiantu K50, Qiantu K25, and Qiantu K20.

They were renamed S1, A1 and A2 respectively in Malaysia, with the Qiantu K25 making its global debut and not previously launched in China, the company said at the time.

($1 = RMB 6.8772)

The post Qiantu inks deal with Mullen to tap US market, K50 supercar to be rebranded as Mullen GT and GTRS appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Insurance registrations for China's NEVs were 113,000 last week, up from 108,000 the week before.

Insurance registrations for new energy vehicles (NEVs) in China increased last week compared to the previous week, with a mixed performance from major EV makers.

From March 13 to March 19, insurance registrations for all passenger vehicles in China were 321,000 units, up from 308,000 units the previous week, according to figures shared by several car bloggers on Weibo.

Insurance registrations for NEVs were 113,000 last week, up from 108,000 the week before.

BYD (OTCMKTS: BYDDY) vehicles continued to see the most insurance registrations, with 38,414 last week, up from 37,141 the previous week.

Tesla (NASDAQ: TSLA) vehicles saw 18,712 insurance registrations last week, up from 17,032 the week before.

NIO was 1,775 vehicles last week, down from 2,170 the week before.

NIO guided for first-quarter deliveries between 31,000 and 33,000 units earlier this month, meaning March deliveries are expected to be between 10,337 and 12,337 units.

The company's insurance registrations for the first week of March, which included February 27 and February 28, were 3,345 units.

Li Auto (NASDAQ: LI) vehicles registered 5,438 insurance units last week, up from 4,243 the previous week.

XPeng (NYSE: XPEV) had 1,296 vehicles last week, down from 1,635 the week before.

Zeekr posted 914 units last week, down from 1,043 units the previous week.

China NEV insurance registrations for week ending Mar 12: BYD 37,141, Tesla 17,032, NIO 2,170

The post China NEV insurance registrations for week ending Mar 19: BYD 38,414, Tesla 18,712, NIO 1,775 appeared first on CnEVPost.

For more articles, please visit CnEVPost.

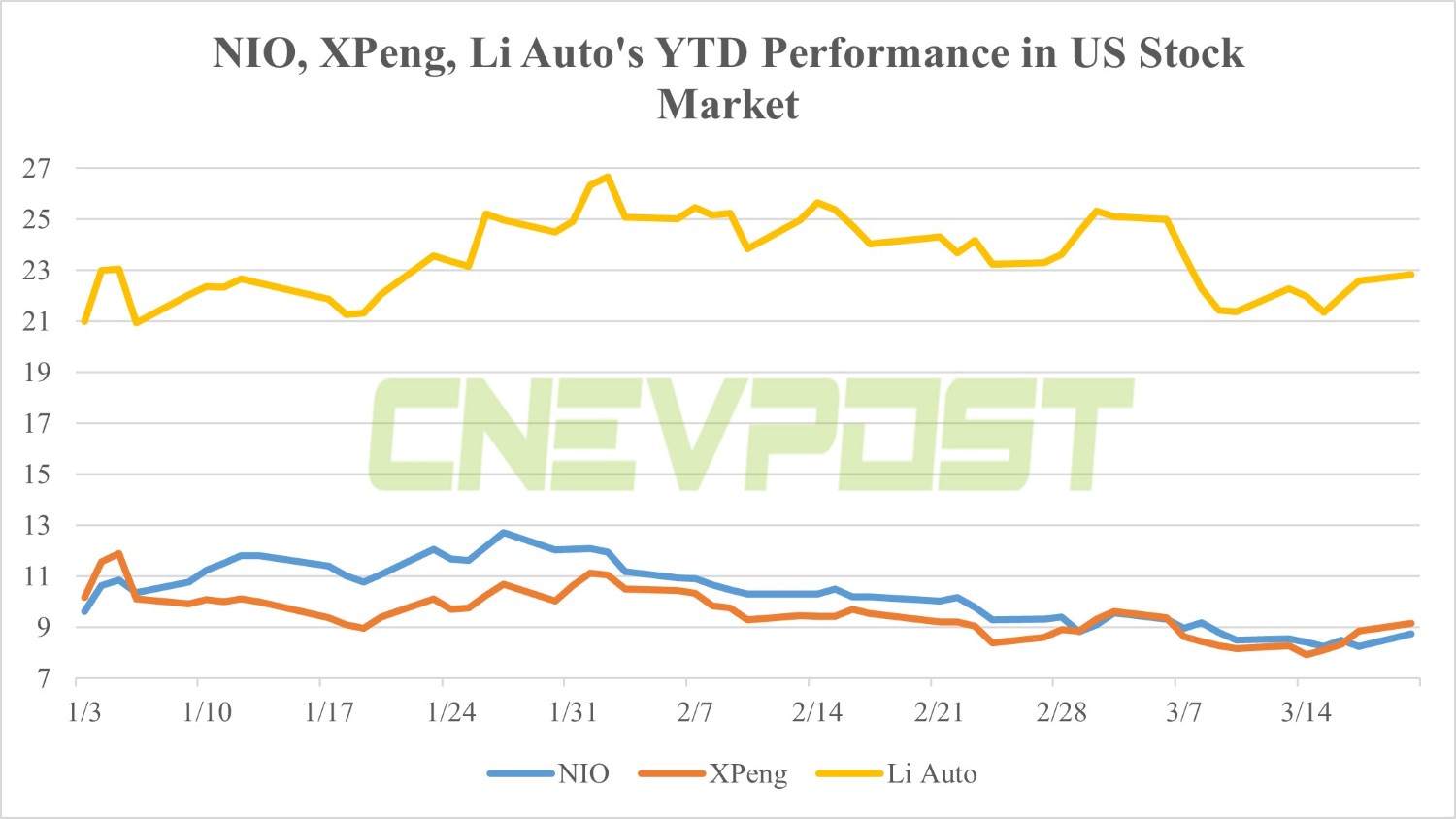

Li Auto leads the pack with superior execution, but risk-reward increasingly favors XPeng and NIO after a drastic sell-off this year, Morgan Stanley said.

Shares of major Chinese electric vehicle (EV) makers have generally suffered a sell-off so far this year, as the sector's weak sales at the start of the year and recent widespread price wars have raised investor concerns.

However, in Morgan Stanley's view, the sales potential of China's EV companies in the second half of the year is underestimated at a time when costs are sliding.

"We think YTD stock corrections should have discounted competition risks but underrate the cost-driven upside to EV margin/volume in 2H, " Morgan Stanley analyst Tim Hsiao's team said in a research note sent to investors on March 19.

As of Monday's close, NIO's (NYSE: NIO) US-traded ADR was down 10 percent this year, XPeng was down 8 percent, and Li Auto was up about 12 percent.

Hsiao's team believes that significant margin pressure from price wars will fuel market concerns about industry profitability and cash flow, especially among new energy vehicle (NEV) heavyweights, namely BYD and Tesla China, which can afford to initiate another round of price cuts in the second quarter.

That, combined with weak full-year sales following the stimulus withdrawal, could dampen sales volumes and margins for EV brands in the first half of 2023, the team said.

Still, the production potential of China's NEV industry in the second half of the year and beyond appears to be underestimated as the decline in prices of batteries and key components accelerates following aggressive capacity expansion in 2022, the team noted.

This could translate into potential margin relief for NEV makers and potentially increase NEV penetration in the second half of the year in a cost-effective manner, the team said.

Hsiao's team estimates a 20-25 percent drop in battery costs for major NEV makers, implying a 6-10 percentage point cost savings.

The price drop of lithium carbonate, a key raw material for batteries, has accelerated in recent days and saw its biggest one-day drop so far this year on March 20, according to a CnEVPost report yesterday.

The average price of both industrial-grade lithium carbonate and battery-grade lithium carbonate fell by RMB 12,500 per ton on March 20, with the latest average price at RMB 272,500 per ton and RMB 312,500 per ton, respectively.

NIO's management said in a call with analysts after the March 1 earnings announcement that they expect lithium carbonate prices to fall back to around RMB 200,000 per ton this year, boosting gross margins back up.

EV makers that can take full advantage of this will not only enjoy margin relief, but also have more flexibility to price their models to further boost NEV penetration in mass markets and lower-tier cities, Hsiao's team wrote in their report.

"That said, the tailwinds from falling input costs may take time to kick in as our checks with major OEMs suggest they are still in discussions with battery suppliers on new terms," the team added.

The team believes that a tougher operating environment will accelerate market reshuffling, with leading EV manufacturers weathering the downturn better than their peers, while the growth of smaller, lagging EV startups could be slowed by a depletion of liquidity in 2023.

Growing investments should also push up cash burn rates. As a result, the ability to optimize working capital and access to market funding will play a more important role in ongoing operations in 2023, the team added.

"Our analysis suggests EV trio (NIO, XPeng, and Li Auto) will still hold fast, backed by healthy balance sheet conditions and better connections to capital markets," Hsiao's team wrote.

The team said they're fully aware of investor worries about EV startups' cash burn that may rapidly deplete their liquidity.

But they believe the EV trio can remain self-funded for the next 18 months, even under the stress-test scenario of a prolonged price war.

"We believe continuous investment would further solidify their technology leadership and enable them to have a better chance of winning out in the next up-cycle," the team wrote.

The team believes that trough valuations mean the market has lowered expectations for EV startups' operational performance and financial resilience in an industry downturn, making any marginal improvement in their sales a meaningful stock catalyst.

Li Auto leads the pack with superior execution, but risk-reward increasingly favors XPeng and NIO after this year's sharp dip, the team said.

Lithium prices see biggest drop this year in China as decline accelerates

The post China EV industry sell-off creates opportunity, says Morgan Stanley appeared first on CnEVPost.

For more articles, please visit CnEVPost.

Filed under: Marketing/Advertising,Plants/Manufacturing,Dodge,Coupe,Racing Vehicles,Performance

Continue reading Dodge Demon 170 revealed: 1,025 horsepower and packing a parachute

Dodge Demon 170 revealed: 1,025 horsepower and packing a parachute originally appeared on Autoblog on Mon, 20 Mar 2023 21:00:00 EDT. Please see our terms for use of feeds.

Permalink | Email this | Comments